If you have ever traveled on the London Underground, you have undoubtedly seen the signs and heard the announcements to “Mind the Gap” between the train door and the station platform. The phrase serves as a reminder to keep travelers safe as they enter and exit the train. Likewise, as a San Diego business owner, you need to “mind the gaps” if you want to accelerate the value of your business prior to a sale. Let’s take a look at the three types of gaps you should be aware of in your business and proactively manage.

Profit Gap

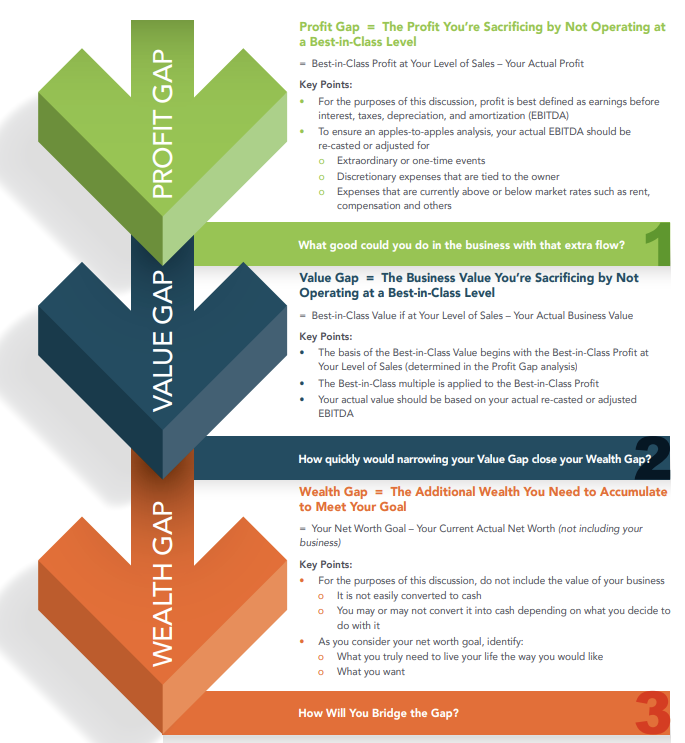

The profit gap is the difference between what best-in-class companies in your industry are reporting compared to what your company reports. Put another way, this is the profit you are sacrificing by not operating at a best-in-class level. This is a value acceleration opportunity, as focusing on increasing your profitability should help lead to being valued at a higher multiple upon your eventual exit.

Value Gap

When you complete a business valuation of your company, you have a better understanding of the value of your business and how you compare to others within your industry. The value gap is the difference between the current value of your company and the maximum value best-in-class companies in the same industry are receiving upon sale. You have the opportunity to accelerate the value of your business by shaping your company into a best-in-class company that will be at the high end of the valuation range.

Wealth Gap

The wealth gap is related to your personal finances and determines how much you need to sell your business for to reach your financial goals. The ultimate goal of understanding the profit gap and value gap helps you determine if your business could be sold for enough to reach your lifelong goals. At CCMI, we work with a lot of business owners to determine the amount they ultimately need to sell their businesses for to achieve financial independence. Without doing this planning, it is unlikely you will know your wealth gap.

At CCMI, we think it is important to “mind the gaps” to better understand how your business fits into your financial plan and see if there are opportunities to accelerate the value of your business. If you need help understanding your wealth gap, please give our team a call to understand how we can assist you.

Infographic courtesy of the Exit Planning Institute.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?