How Valuable is Your Business?

As a San Diego business owner, your business is often the most valuable asset in your net worth. Just as you follow a plan in building your business, you should also follow a plan for preparing to exit your business. CCMI has previously written about why focusing on the value of the business is important and how an assessment can help you determine what you need to monetize from your business. This blog post focuses on the five stages of value maturity—Identify, Protect, Build, Harvest, and Manage—and the value maturity index. As you move up the stages of value maturity, you will often find your business value, and therefore your personal wealth, grows along with it.

Identify

As most of your net worth is locked in your business, you want to maximize its value. It is difficult to understand what your business is worth without a business valuation, and having a system in place to maximize and monitor the valuation creation is an important step. Start the process by obtaining a professional valuation and determine how your business compares to the benchmarks in your industry. If you are receiving a lower valuation, you can focus on the factors that would allow your company to be valued at a higher multiple within your industry. (See Build for more information.) Continue performing valuations at regular intervals to determine if you are expanding the value in your business and moving into the higher multiples at which your industry sells.

Protect

Once you have identified the baseline value, you want to protect the value you already have by mitigating any personal, financial, or business risks. Protecting existing value is the first step in building value. To best protect your value, you must consider the 5Ds: death, disability, divorce, distress, and disagreement. Although you may feel you will not be affected by one of those, without preparing for the worst, your value could be negatively impacted. Remember that valuations are based in part on the real and perceived risks from a buyer’s point of view. Actions to reduce risk are common sense to preserve what value you already have.

Build

After you have protected your business’ value, you can now focus on expanding it. Building value comes from increasing your cash flow (EBITDA) and/or improving your multiple. Your multiple is the number assigned by the private capital markets to value your tangible and intangible assets, along with the risks associated with your business. Improvements to your intangible assets (such as human, structural, customer, and social capital) are often where the greatest increases in building value can occur.

Harvest

You are likely building a business to eventually exit it and harvest the fruits of your labor. Harvesting involves reaping, gathering, and sowing something you’ve grown. There are many paths on which you can exit and many professionals you should work with to get the most value out of your exit. Your value maturity is partially determined by how well you understand all your exit options. We suggest you explore all possibilities, including private equity, family offices, investment bankers, and ESOPs, along with internal succession, to determine your best path and how you can maximize your business value during the sale. After reviewing your options, you may discover you do not want to sell your business and would rather continue to build value.

Manage

Managing value is the last stage of value maturity because it represents full maturity. While you are likely managing the value throughout the entire process, the most important time to do so is while exiting your business. However, it’s not just the business value you need to manage; equally as important is managing your personal value and personal financial net worth. If you actively manage value throughout the entire process, you may emerge financially independent from your business with many options during the exit process.

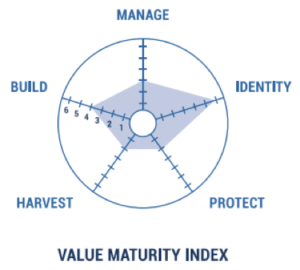

Value Maturity Index

In Christopher Snider’s book Walking to Destiny, he teaches the concept of a value maturity index. Draw a circle and label five points around it: Identify, Protect, Build, Harvest, and Manage. Draw a line from the center of the circle to each label and add six hash marks. You give yourself a score of six if you have fulfilled everything in a category and a score of one if you have done nothing at all in the segment. As there is no middle option, you either rate yourself above or below average for each category. Draw a line connecting each segment, shade in the area, and the non-shaded area represents your room for improvement. Do this regularly to help you see the value you are creating in your business. An example of what this looks like is included from the Exit Planning Institute.

Conclusion

If you are a San Diego business owner looking to explore how your business value fits into your overall personal financial plan, let one of our advisors know. We can be of assistance evaluating if your current value and exit options will allow you to reach financial independence.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?