By Matt Ryan

Congratulations! You have landed your first job! Now what do you do with that first paycheck? It may be the largest check you have ever received. Should you move out from your parents’ home, travel, participate in activities with friends, or buy a new car? With endless spending options, how do you keep yourself focused on saving or investing when more exciting things are happening right now? Luckily for Generation Y, aka millennials, time is on our side. If we choose to use time wisely, it can pay huge dividends in the future.

You may have heard of the magic of compounding. When your interest earns interest it is said to be compounding. Compound interest is a way to amplify your savings over a long period of time. Essentially, you are making money on the money you have already made from your initial investment. The earlier you start to save and invest, the more time you have for your money to compound as you move towards financial freedom. Here are some steps to get you started:

Set a budget and live within your means!

A key factor to starting off your financial life on the right foot is to keep track of your expenses and try to keep them as low as possible. Right out of college, many graduates are used to living on a meager budget. Taking some time to find the right balance of savings and spending is vital to how you end up managing your expenses over your lifetime. From our experience with clients, it is much harder to cut expenses than to increase them. Spending your entire paycheck every week also limits your flexibility. With today’s millennial generation looking to travel more and move from city to city, high expenses make transitions more difficult to accomplish. They may limit opportunities.

Automatic retirement fund contributions

Before you even get your first paycheck, if you are eligible, it may be a good idea to set up automatic deposits from your paycheck into a retirement account offered by your employer like a 401(k) plan. Sometimes your employer will even match a portion of your contribution up to a certain limit! In the case of a company match, it is usually wise to contribute up to the matching amount; don’t leave free money on the table. If your employer does not offer a retirement plan as a benefit, you have the option of setting up a traditional IRA or a Roth IRA. Automatic deposits allow you to put away money before it goes into your checking account. This way you won’t risk forgetting or skipping a monthly contribution.

Investment Selection

Some young professionals have difficulty choosing the actual investments once they have made the commitment to invest. Investing takes time. It’s important to understand what you are investing your money in. If you’re struggling to find the right allocation for your portfolio, it is important to remember not to let your emotions control your decision making. Here at CCMI, we believe in taking a long-term approach to investing. We help our clients stay disciplined to a long-term diversified investment approach despite any short-term market volatility. As a young investor, educating yourself on the tools of investing is important in understanding your portfolio allocation and portfolio results. It may be worth reaching out to a professional to help better educate yourself. This can help prevent you from getting caught up in the high flying, risky, hot topics of today’s market, which can significantly impact your portfolio returns over the long-run. A professional may also help you to develop and stick to a long-term strategy.

While there’s nothing wrong with traveling, buying a new car, and moving out from under Mom and Dad’s roof, spending too much too soon may cause you to lose the benefit of time.

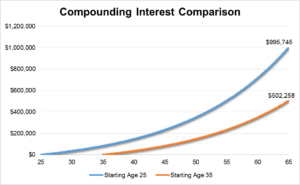

Let’s look at a compounding interest example. The chart below compares the ending balances at retirement (age 65) between someone who starts to invest $500 per month at age 25 and someone who starts investing the same amount at age 35. We used a 6% annual rate of return compounded monthly for this demonstration.

Warren Buffett once said, “Someone is sitting in the shade today because someone planted a tree a long time ago.” This quote, by one of the greatest investors of all time, can be applied to your financial life. We, as millennials, have the opportunity to act responsibly with our finances and prepare ourselves for the future. So, set your budget and track your spending, live within your means and stick with your savings and investing goals. You may not see an immediate impact, but over time you will see your financial life start to flourish. The minor sacrifices you make now by investing versus spending can have a significant impact on the sacrifices you may or may not have to make later.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?