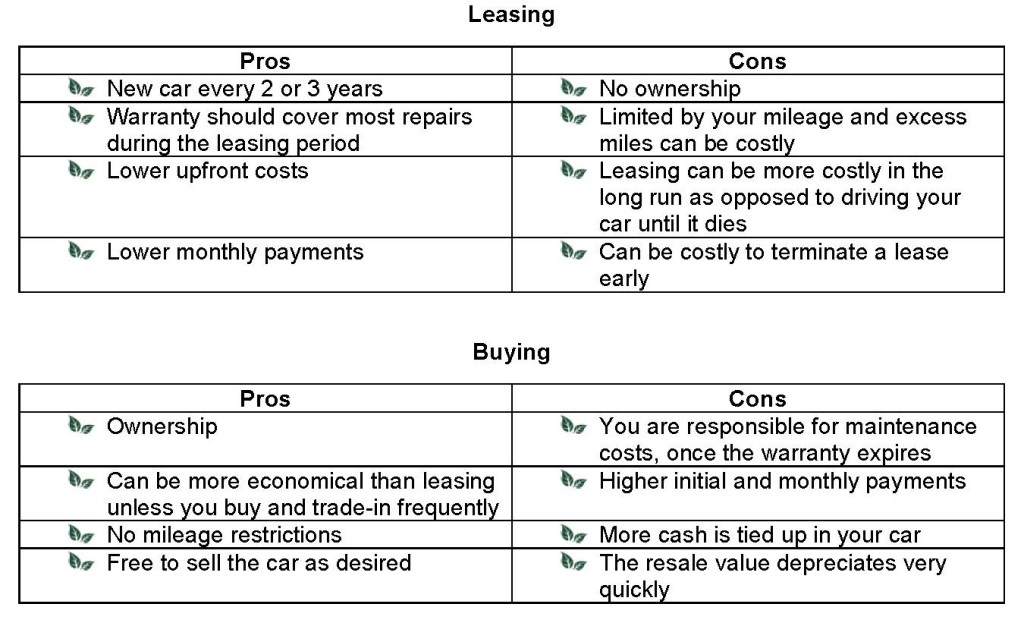

Clients frequently ask us what they should do when thinking about buying versus leasing a car. Like many topics in financial planning, it depends on your individual lifestyle and priorities. Do you need a brand new car to impress clients or are you more concerned about the monthly payments? Do you like the feeling of a new car every few years or do you care more about the long-term savings? Where your priorities lie will help you to determine the best course of action. Take a look at a few of the pros and cons for each option and decide which option best fits your situation.

When deciding on buying or leasing a car it is important to consider both options in order to find what the right fit is for you. Leasing gives you the option to get into a shiny new car every few years, generally with lower monthly payments then buying it outright. If you want to give your car a name, use and abuse the interior and keep it for years, then buying may be the better option financially even with a higher up-front cost. If you are still not sure which option is right for you, then we recommend using one of the many online tools such as the questionnaire on www.bankrate.com. It will walk you through a series of questions about your priorities and give you a recommendation on which path to take. As we said before, like almost everything in financial planning, it all depends on your individual situation.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?