The One Big Beautiful Bill Act (OBBBA) introduced several permanent and temporary provisions that may impact retirement planning in the next few years. While there…

How Will the “One Big Beautiful Bill” Affect Retirement Planning and Business Owners? Key Takeaways: The recently passed tax and spending bill, the “One Big…

Key Takeaways A Roth conversion can help you grow savings tax-free and provide tax-free qualified withdrawals in retirement but timing a conversion is critical. There…

From day one, business owners should begin planning their exit from their companies, which may be surprising or sound premature for new entrepreneurs. Over the…

Restricted stock units, commonly referred to as RSUs, are becoming an increasingly popular equity compensation option not only in large corporations and publicly traded companies…

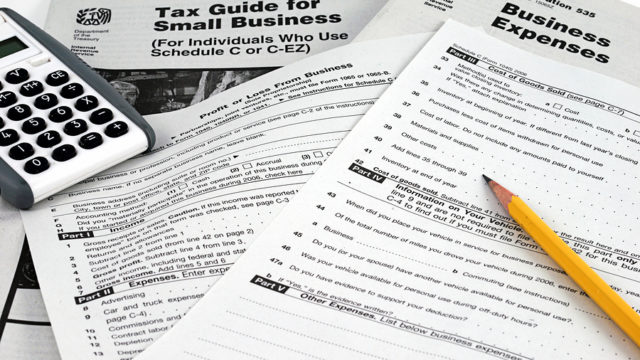

Paying taxes is inescapable, and as our wealth and financial complexities grow, so does our tax liability. Developing and implementing wealth management and tax strategies…

With the stock markets down, you may be concerned looking at the performance and value of your investments. Some of your securities, which you may…

As 2022 quickly draws to a close, there are various planning issues to consider that may affect your tax payments and financial situation in 2023….

As business owners, we know year’s end is the time most companies are looking for ways to minimize their tax liability. This year, there are…

As we near the halfway point in 2020 and look back at the past six months, a lot has changed. With the passage of the…