Throughout your career, you build up your retirement savings to enjoy a comfortable second act that allows you to pursue more passions, travel, and spend time with loved ones. However, many retirees may overlook the pace at which they spend their savings until they’re actually in retirement. Without proper planning and an income and withdrawal strategy, retirees may risk overspending or underspending in retirement.

A tendency to overspend or underspend is often rooted in deeply held beliefs and our history around money, which could lead to detrimental financial and emotional consequences. The key is to develop a strategy that allows you to enjoy your hard-earned wealth without the fear of running out of money or the regret of unnecessarily delaying your goals. Let’s explore these mindsets in retirement planning, the risks associated with each, and how to strike an appropriate balance.

Money Mindsets and Spending in Retirement

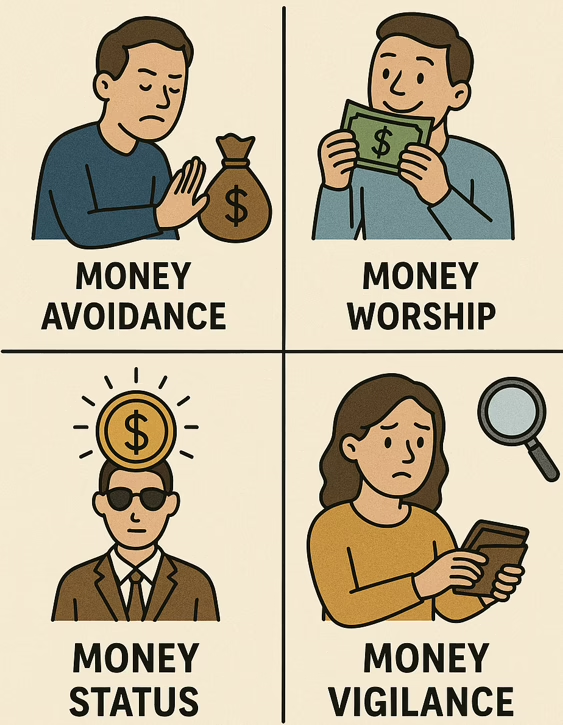

What leads to overspending or underspending in retirement? Our highly personal money habits, including spending in retirement, are often linked to a lifelong perspective on money shaped by our past experiences, family, and values. Some of these mindsets can lead to financial behaviors that could have lasting negative impacts, which include:

- Money Avoidance: People with this mindset often have a negative view of money, associating it with greed or corruption. As a result, they may avoid financial planning or unnecessarily deprive themselves of financial comforts.

- Money Worship: This mindset involves associating wealth with happiness, which can lead to overspending or acquiring debt.

- Money Status: Similarly, people with this mindset equate wealth with status, spending to accumulate symbols of wealth, such as houses and cars, that could lead to higher debt or other risks.

- Money Vigilance: Rather than overspending, people with this mindset may have an urge to compulsively save to ensure their financial security, which can lead to experiencing financial anxiety or missing out on joyful opportunities.

Understanding how these mindsets may affect your spending in retirement is an essential first step in developing a spending plan that supports your life in a way that feels sustainable and realistic to you.

What are the Risks of Overspending in Retirement?

The realities of overspending in retirement can have lasting consequences. This often occurs due to various reasons, such as:

- Withdrawing larger amounts early in your retirement for travel, entertainment, and more

- Failing to adjust spending even when markets are down or circumstances change, which could mean selling investments at a loss or being unprepared for the unexpected

- Lifestyle inflation, or spending more as you get more comfortable in retirement

What are the consequences of having less money in retirement? With less income and assets in your portfolio, you could be at risk for:

- Outliving Your Savings: As people live longer, your retirement savings must sustain you for longer than historically necessary. Failing to consider your spending pace could mean your funds run out faster.

- Less Money for Goals and Emergencies: With fewer funds, you may have to delay pursuing other goals later to ensure you’re meeting your financial obligations. Additionally, you may have less contingency money available in the event of an emergency, a medical event, or other unforeseen expenses.

- Going Back to Work: The risk of overspending may mean you have to supplement your income by going back to work, which may not have been part of your retirement plan.

What are the Risks of Underspending in Retirement?

While the risks of overspending in retirement may seem evident, you may overlook the unforeseen consequences of underspending, which could be caused by:

- The fear of outliving your savings

- The challenge of switching from a saver to a spender mindset upon retirement

- Wanting to pass on more wealth to your heirs

While diligent saving served you well on your path to retirement, failing to spend what you’ve built could lead to risks, such as:

- Missed Opportunities: Avoiding spending your retirement savings could mean you’re unnecessarily sacrificing experiences that could enrich your life even though you can afford them.

- Higher Taxes: Required minimum distributions (RMDs) are calculated based on how much you have saved in certain retirement accounts. A larger balance means higher distributions, which would increase your taxable income and tax liability. Additionally, the intention of passing on more wealth to your heirs could also result in a higher estate tax for your loved ones after you pass.

- Financial Anxiety: Hyper-vigilant saving and cutting costs can lead to increased stress and anxiety, undermining the purpose of a chapter that should be about enjoying a life of hard work and financial discipline during your career.

How to Avoid Overspending and Underspending in Retirement

Managing your nest egg requires a delicate balance to avoid the risks we’ve discussed while enjoying a new chapter. We encourage you to partner with a financial advisor to share your concerns and develop a sustainable plan that covers these areas:

- Build a Budget: A fundamental of financial planning, knowing what’s coming in (your income) and what’s going out (your expenses and spending) is the first step in managing and sustaining your savings. For example, understanding that your bills and emergency fund are sufficiently covered may give you the freedom to spend with less worry. On the other hand, you may want to adjust your spending if you consistently overspend, which could jeopardize your long-term financial security.

- Design a Strategic Withdrawal Plan: If you have various income streams and retirement accounts, a strategy can help you understand when and where to pull from your funds to preserve more of your wealth, manage taxes, and sustain your needs at various stages. For example, an advisor may suggest using low-risk assets, such as cash or bonds, or funds from tax-deferred accounts first, to give your other investments more time to grow and supplement your income in later years.

- Review Insurance Options: Many clients who underspend are concerned about outliving their savings or not having enough saved for long-term care or future medical expenses. In these cases, long term care insurance insurance could provide peace of mind. Long-term care insurance and other features can help cover unexpected expenses that may arise later due to declining health. We recommend partnering with insurance professionals to understand the full benefits and tradeoffs of this type of policy.

- Create a Tax Strategy: Work with your advisor or a tax professional to develop a tax plan to manage RMDs, taxable income, and estate value. Understanding the intersection of your income and taxes can provide greater clarity on your spending.

- Diversify Your Investments: Underspenders may not like to see their portfolio balances fluctuate due to various market changes and influences. However, balanced, diversified investments can better offset “losses,” giving you more peace of mind that your portfolio is appropriately allocated to manage risks and market cycles.

- Define Your Legacy Goals: It’s admirable to want to save more of your wealth for your heirs. Still, there are various ways to achieve your legacy goals while also enjoying the wealth you’ve built. Working with an advisor can give you a clear picture of your wealth and estate plan, alleviating the need to save every penny for an inheritance.

Managing Spending in Retirement: Partner with CCMI

In addition to the emotional toll of transitioning into retirement, managing your spending is a unique and ongoing process for every retiree. At CCMI, we frequently work with pre-retirees and retirees to develop withdrawal and income strategies tailored to their specific needs. We can also help with:

- Projecting Income: Your needs and goals may change over time but with proper planning and income forecasting (considering how different scenarios will impact your income), you can adjust your spending to support what you want to do without compromising your security.

- Making Adjustments: Whether you want to save toward a big purchase, weather a down market, or plan for taxes, we can help you make adjustments to your plan to sustain your income best and manage your risks.

- Reviewing Your Plan: Overspending or underspending often results from not fully understanding your financial position at any given time. We regularly review your plan, budget, and spending to help ensure you’re on track with your income needs without depleting your savings too quickly or unnecessarily accumulating more.

We’re constantly monitoring these areas of your retirement plan so you can focus more of your time on enjoying the fruits of your career. Do any of these mindsets sound familiar? Whether you’re an overspender or underspender, we can help you navigate financial behaviors and emotions to realize the full potential of your golden chapter. Contact us to learn more about how we guide pre-retirees and retirees through every stage of retirement planning.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?