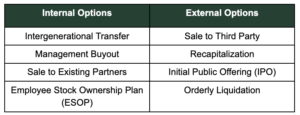

CCMI has seen its fair share of business exits working with San Diego-based business owners, and we’ve recently observed an uptick in selling activity. Previously, we’ve shared why owners should prepare for their exit, how to get the most out of a sale, and how to ensure their business is attractive and ready to sell. This blog post covers the “what,” featuring eight exit options you should be aware of as you consider your exit from your business. The options are:

If you decide to sell, you will be unlikely to do so quickly, as it takes time and commitment to do it right. Being aware of the pros and cons of each of your options is important in understanding which one may be right for your company. Below we will cover the benefits and disadvantages of each.

Internal Exit Options

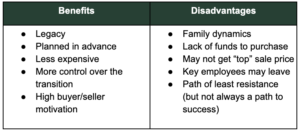

Intergenerational Transfer

This is a top choice for many business owners, as it may also be your dream to pass your business to a family member. The opportunity to create a family legacy appeals to many business owners, but it doesn’t come without risk.

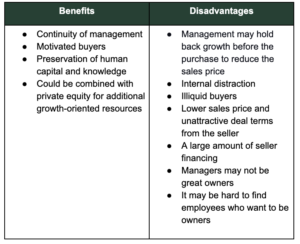

Management Buyout

This may be a good option for business owners who want to reward key employees and managers for their role in building the business and have confidence they can continue to grow. In this option, the business owner sells all or part of the business to the management team, but the downside is that management must use the business’s assets to finance a large part of the purchase price.

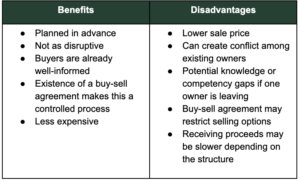

Sale to Existing Partners

This option doesn’t work for single-owner businesses but may be a requirement of a multi-owner firm with an existing buy-sell agreement.

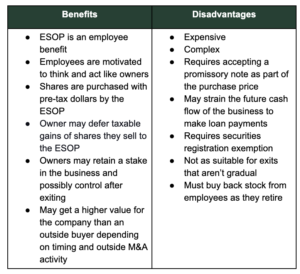

Employee Stock Ownership Plan (ESOP)

An ESOP is a qualified, defined contribution benefit plan for employees designed to invest primarily in the sponsoring employer’s stock. ESOPs require the company to borrow funds to buy the shares from the owner. The shares then go into a trust on behalf of the company employees.

External Exit Options

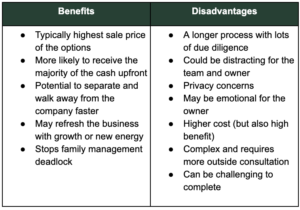

Sale to Third Party

The transaction may include a full or partial sale for liquidity to a strategic buyer, financial buyer, or private equity group. The sale process may be negotiated, a controlled auction, or an unsolicited offer.

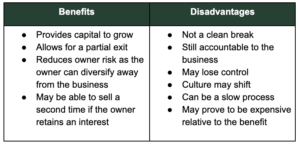

Recapitalization

In this type of sale, a lender or equity investor adds capital to fund the company’s balance sheet and acts as a new partner in the business, with a minority or majority interest.

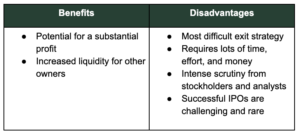

Initial Public Offering (IPO)

An IPO allows you to sell your business to the public for a potential profit. This option is not realistically available to most small and middle-market companies.

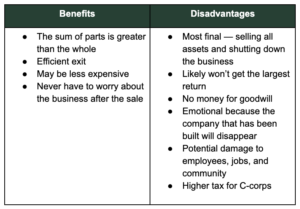

Orderly Liquidation

This is the quickest process to close the business if the asset values exceed the ability of the company to produce the income required to support an investment.

Which Exit is Right for You?

While each exit option has variations, they generally fall into one of these eight categories. As a business owner, you will need to decide your objectives for exiting and begin to look into which options may be viable. Planning for the business exit is only part of the overall exit process, as you will also need to plan your personal finances around your future life. Give one of CCMI’s advisors a call if we can be of assistance as you go through your exit planning process.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?