High inflation over the last few years has caused many retirees and pre-retirees to be concerned about outliving their savings. With shifting market conditions, increasing life expectancies, and rising living costs, crafting a portfolio and investment plan that supports growth and income is critical. We’ll explore the common financial challenges we often discuss with pre-retirees and retirees and strategies to consider to provide more peace of mind.

The Longevity Risk

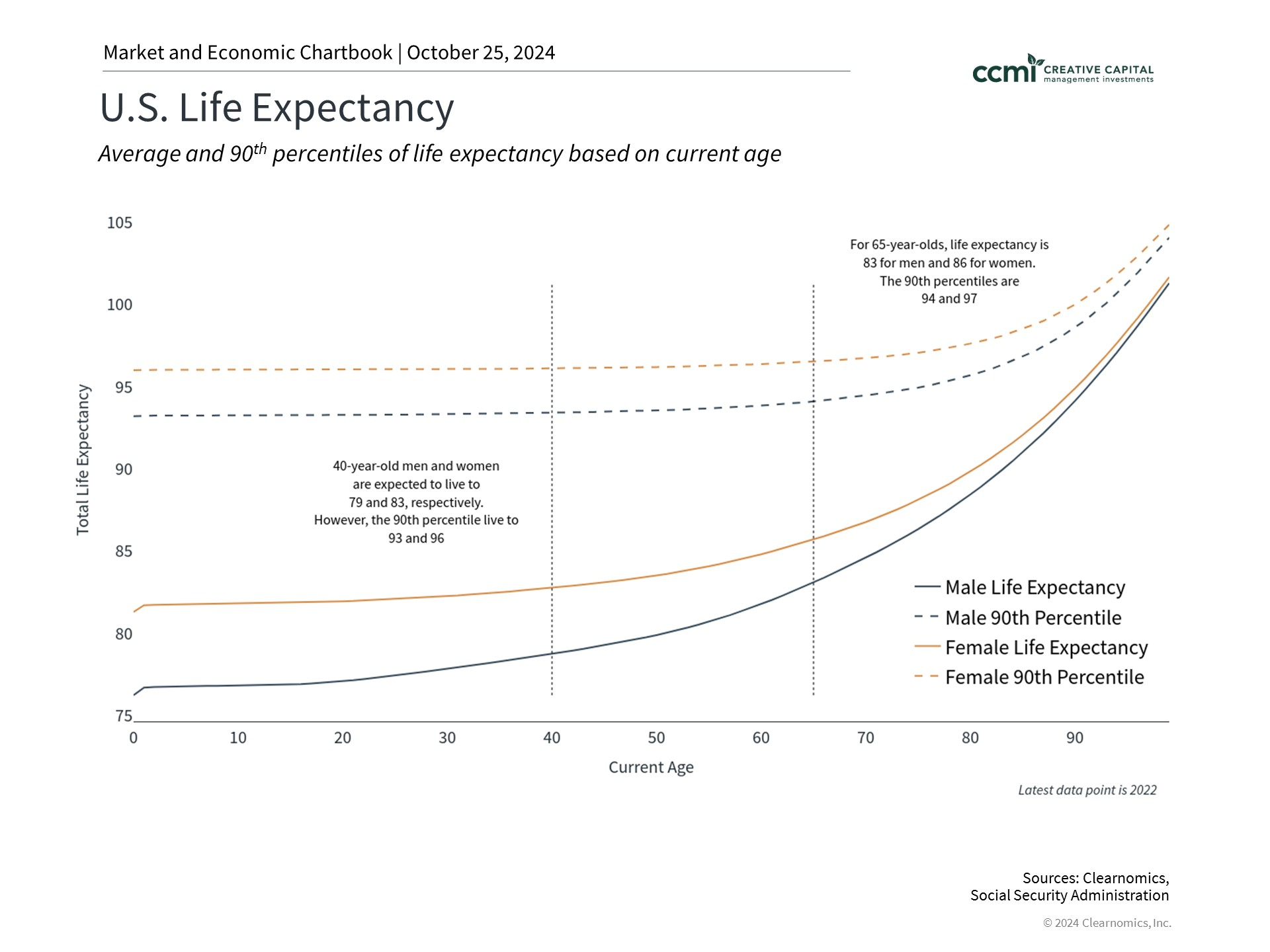

In addition to inflation, one of the biggest modern challenges pre-retirees and retirees face is increasing life expectancy, which could lead to outliving their savings. According to the Social Security Administration (SSA), 40-year-old men and women today have a life expectancy of 79 and 83, respectively, as shown in the chart below. However, the 90th percentile could live well into their 90s. Similarly, men and women who are 65 years old today could live to 83 and 86, on average, while the 90th percentile could live to 94 and 97, respectively.

The difference between a 20- and 30-year retirement can have dramatic implications for investment portfolios and financial plans. Understanding life expectancy is a significant factor when working with a financial advisor to develop a long-term strategy that aligns with your situation and goals.

Rising Cost of Living

Rising prices due to inflation decrease the purchasing power of savings, making it more challenging to plan for the future. The SSA recently announced a 2.5% cost-of-living adjustment (COLA) for 2025 to help offset the higher cost of goods and services. A noticeable difference from the 8.7% adjustment in 2022, the lower adjustment for 2025 signals slowing inflation.

Still, the rising cost of living concerns pre-retirees and retirees, especially in states like California. In San Diego alone, the cost of living is 44% higher than the rest of the country. Everyone’s income needs, expenses, and goals are different. Accurately forecasting living costs and other retirement expenses, such as planning for healthcare or assisted living, is critical in comprehensive retirement planning. Similarly, people several years or decades away from retirement should also understand projected needs and income in relation to early, consistent, and long-term investing.

Developing a Withdrawal Strategy

A strategic and flexible withdrawal plan, considering inflation, life expectancy, and the rising cost of living, can help retirees understand the rate at which they can spend comfortably. Many clients may be familiar with the 4% rule, which suggests a 4% annual withdrawal rate from portfolios in retirement is “safe” and unlikely to exhaust savings over a 30-year retirement window. While a good rule of thumb for some, the approach does not account for individual factors like longer life expectancies, differences in portfolio construction, or varying risk tolerances. It’s critical to go beyond a one-size-fits-all solution. Working with a financial expert can help you project your income needs and tailor a suitable withdrawal strategy unique to your needs, risk preferences, and goals.

Navigating Rising Costs in Retirement: How CCMI Helps

Retirees need portfolios that generate income and growth to ensure their assets maintain their quality of life over decades. Even as inflation slows, costs remain high — especially in expensive areas — and with increasing life expectancies, it’s critical to have a portfolio that can support a long and fulfilling retirement. We specialize in helping pre-retirees and retirees plan for the future, providing peace of mind, attentive guidance, and tailored strategies. We often guide clients in areas such as:

- Projecting Retirement Income: We can help you forecast your income needs to develop a plan to support your ideal retirement, considering your future income streams, inflation, and cost of living, with embedded guardrails for the unexpected.

- Developing a Flexible, Strategic Withdrawal Plan: We can help you design a personalized withdrawal strategy considering your immediate and long-term income needs, risk tolerance, and life expectancy factors. With continual monitoring and adjusting for market conditions and other circumstances, you can have peace of mind that your savings will be sustainable throughout your retirement.

- Making Adjustments or Staying the Course: Life and markets can change unexpectedly, so we continually monitor your portfolio’s performance and your evolving needs. If adjustments are required due to inflation or personal circumstances, we will proactively recommend strategies to keep your plan on track.

- Navigating High Costs of Living: Retiring in a place like San Diego has unique financial considerations related to maintaining your quality of life. We can help you draft a budgeting and investing plan that considers local expenses like housing and taxes and preserves your financial security.

We want to empower you at every stage of life with a financial strategy designed for your current and evolving needs. With a trusted partner on your side, you can move forward knowing your plan is built to adapt as your goals change. Whether you’re approaching retirement or ready to begin planning for the long term, we’re here to help. Contact our team to learn more about how we can help you achieve your retirement goals with more clarity and support.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?