An entrepreneur who buys businesses from retiring owners recently shared his methodology for business valuation with me. The concept of business attractiveness and readiness in planning for a business exit is a critical determinant of the revenue multiple he pays for a business. For example, if he finds a company that has been for sale for an extended period, it could indicate a glaring issue a potential buyer must overcome. The difference between selling business owners only paying attention to the attractiveness rather than the readiness of the business sale could mean the loss of substantial dollars during the sale. A business not only needs to be attractive but also ready to sell to earn top dollar.

As a business owner, you know every detail of your business but may be too close to the operations to see the areas that require improvement when you’re ready to sell. Walking to Destiny, a book authored by Chris Snider, Exit Planning Institute founder, suggests that business owners complete personal, financial, and business assessments to produce scores for business attractiveness and exit readiness.

Business Attractiveness

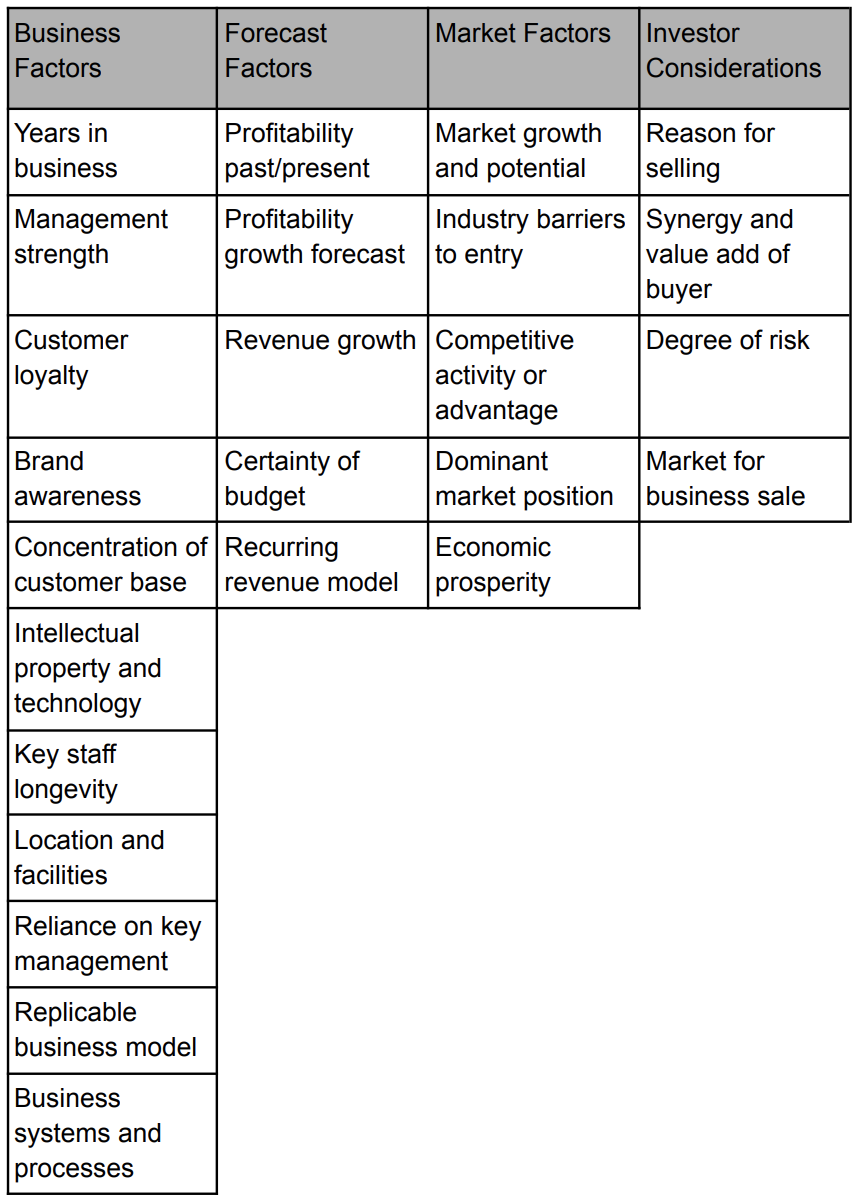

Business attractiveness helps you answer how competitively strong your business is in the eyes of a buyer. An attractiveness assessment enables you to rate your business on a scale of one to six (with one being worst and six being best) on the following factors:

You then divide your total score by a maximum score of 150. If you have a score below 50%, your rating is below average, and you likely need to continue working to make your business more attractive. If you get a score between 50% and 72%, you’re slightly above average, and if you’re over 72%, you’re likely among other industry leaders with respect to attractiveness.

Exit Readiness

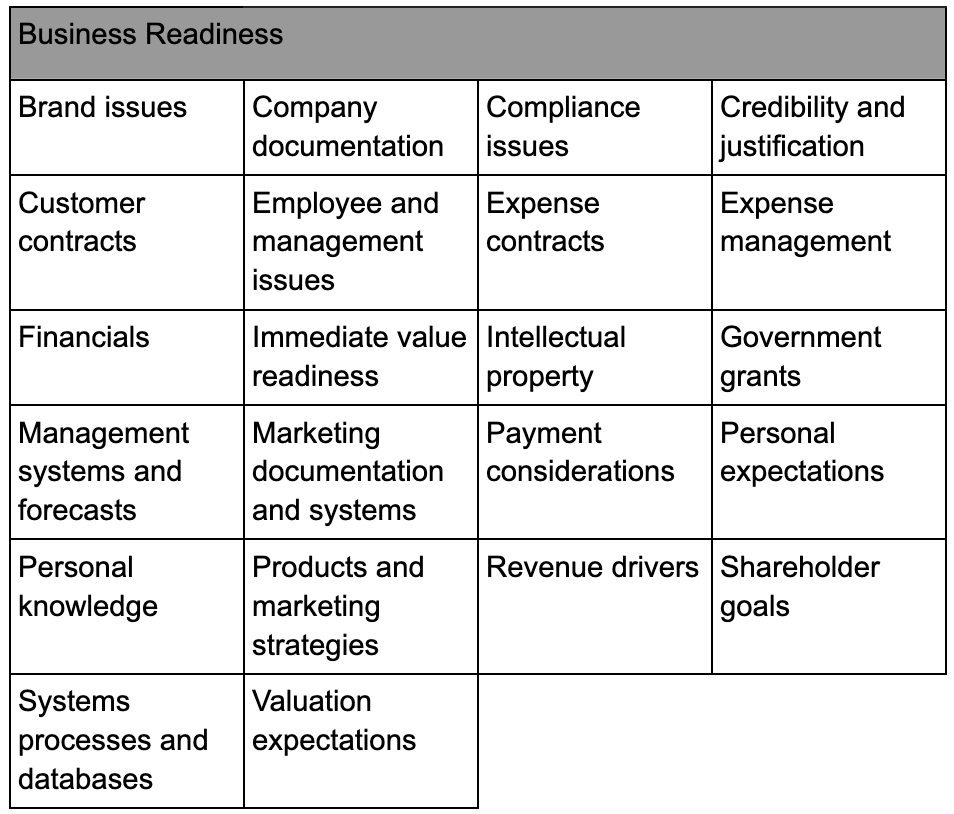

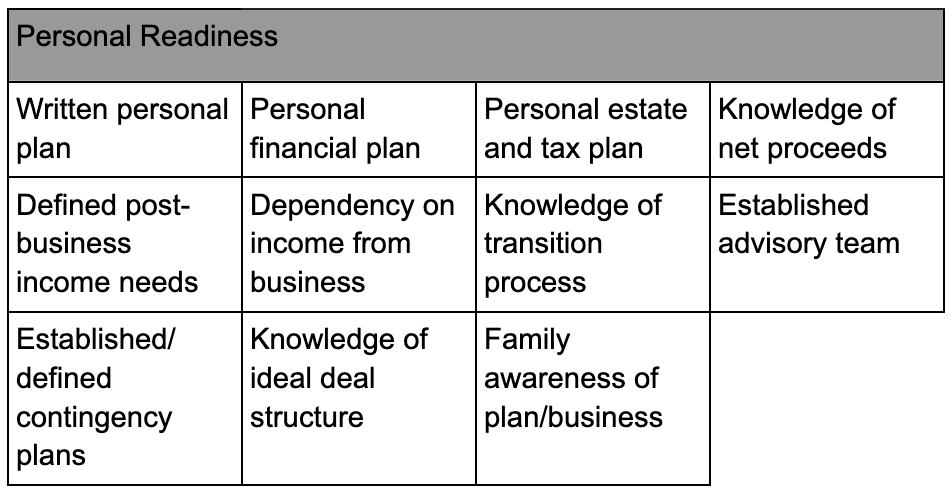

Exit readiness helps you answer the question of how prepared you and the business are for a transition. An assessment to assist in evaluating your business and personal exit readiness allows you to rate yourself on a scale of one to six (with one being worst and six being best) on the following factors:

You then divide your total score by a maximum score of each (top score of six multiplied by the number of total criteria measured). If you have a score below 50%, your rating is below average, and you likely need to continue working to make your business more financially ready for a transition. Scores between 50% and 72% are slightly above average, and over 72% are considered industry leaders with respect to readiness.

Attractive and Ready

Attractiveness and readiness are not the same. While your business may be very attractive, you may not be ready to exit it. Likewise, you may be prepared to leave your business, but it may not be attractive to potential buyers. For this reason, being ready, both professionally and personally, is just as crucial as attractiveness for you to consider as you progress toward your business exit.

CCMI can help you complete a financial plan to determine if you are personally and financially prepared and positioned to transition away from your business. Give one of our advisors a call to see how we might be able to assist you as you move toward your business exit and post-career goals.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?