In our recent Market Updates webinar, we welcomed guest Jeffrey Kleintop, senior vice president and chief global investment strategist at Charles Schwab. We discussed where the markets are headed and what financial implications you can prepare for within your investments. Below, we’ve outlined key takeaways from the webinar.

A Powerful Recovery

In 2021 and beyond, we have gone from recession to recovery, and we are now in expansion. This has been the most powerful snapback in 50 years of history. We already see an increase in spending and job growth as the services sector prepares to come back online later this year.

High Global Outputs

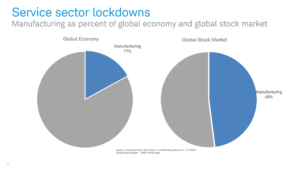

We are also currently at an all-time high in terms of global output. Global Manufacturing makes up a larger percentage of the Global Stock Market (48%) than the Global Economy (17%), as shown below.

Earnings Recovery

What is more important to the stock market, however, is earnings recovery. Earnings are expected to be higher outside than inside the U.S. This is because companies outside of the U.S. are more economically sensitive (in the materials sectors, etc.) than the technology and healthcare companies that dominate the U.S. stock market, which held up better last year, and tend to be less economically sensitive.

Reflation Risks

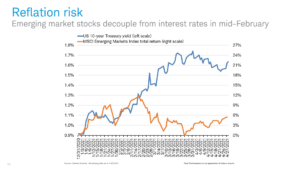

In terms of risks in 2021, prominent economists have warned us about reflation risk and potential inflationary overheating in the U.S. economy. In addition to more stimulus from Washington, there may also be an eventual pullback from the Fed in the bond market. As the graph below shows, previously, interest rates and emerging market (EM) stock yields moved together. However, around February 17, 2021, at 3%, they parted.

It’s normal for stocks to go up with rising interest rates. Bonds are the area of the market that may struggle. The risk to bonds could be similar to the Taper Tantrum of 2013, when the market experienced a slow recovery; however, the Fed waited three years to begin hiking interest rates and decided to do so quickly to catch up.

In terms of how this activity could affect EM companies, we developed the following conclusions:

- Interest rates aren’t the only thing going up. Commodity prices (food, lumber, oil, etc.) are soaring. Many EM companies produce commodities and tend to be highly correlated to changes in commodity prices.

- The EM Financial Conditions Index is a measure of how hard it is for EM companies to borrow. We do not believe they’ll have a problem borrowing in the near future; however, they may run into difficulty in one or two years. As a result, we don’t project a reflation risk for EM companies.

The Next Bubble in Green Stocks?

Investment bubbles usually occur when price exceeds an asset’s value, and there is high investor confidence and an abundance of money available. This is reflected in the emergence of special purpose acquisition companies (SPACs), the non-fungible token (NFT) market, and cryptocurrency.

According to Jeff, the next bubble may occur in “green” infrastructure. Interest appears to be building throughout the world, with a large percentage of the European Union’s budget allocated to green infrastructure and the Biden administration investing in electric vehicles and other renewable energy. Green stocks range across many industries, including industrial machinery, electric utilities, semiconductors, and electrical equipment, and many of them could benefit from this influx of capital.

From an investor’s perspective, it’s worth noting that while many bubbles have been predicted in the past, they can take years to form and “burst.” It’s critical to discuss your concerns with a financial advisor regarding green infrastructure and Environmental, Social, and Governance (ESG) investing, to maintain vigilance and a diversified portfolio.

New Cycle, New Leaders

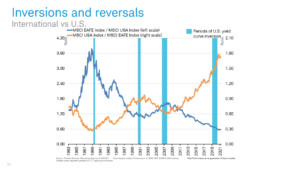

We are on the cusp of a shift from growth to value and from the U.S. to global. Usually, long-term rates are higher than short-term rates (e.g., mortgage rates are higher than bank savings rates)—but not always! Every time we’ve seen an inverted yield curve where long-term rates drop below short-term rates, it has preceded a recession, and stocks fell from 10% to more than 20%. The chart below shows where the yield curves are inverted on the orange dots. The orange dots precede recessions (gray columns) by a year.

Is the global economy vulnerable to a shock? Yield curve inversions with a wide margin, such as the one in the “Shark Chart” below, may indicate a sign of a recession; the jaws open wide, and then they snap shut if you’re not careful!

It’s important to note this is not a six-month or one-year cycle—this is a 10-year cycle. The U.S. economy will begin to lag relative to non-U.S., and international stocks will outperform the U.S. Whatever is outperforming, the recession resets the clock. We’ve seen this occur in the past: in the 1980s, international stocks outperformed; in the 1990s, U.S. stocks outperformed; in the 2000s, international stocks outperformed, and in the 2010s, U.S. stocks outperformed.

Since we’re starting a new cycle where we are beginning to see international stocks outperforming U.S. stocks, it is essential to maintain exposure to international and value stocks. This could be a missed opportunity for investors who overlook this key indicator in the markets and the reason we keep a healthy exposure to international stocks at CCMI.

Future Outlook

As more people get vaccinated and begin to return to work and pre-pandemic activities, we remain optimistic for the future. As with any market cycle, there are opportunities and risk considerations for every type of investor, and we’re committed to keeping you informed. If you have any questions about how these updates may impact your portfolio, please contact one of the four CCMI advisors, and we would be happy to have a conversation with you. If you would like notifications of upcoming webinars and events, please contact us.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?