Continuing our series of posts about planning in the age of COVID-19 and following last month’s blog on how Medicare applies to COVID-19 treatment, it’s time to review your estate planning documents in the age of the coronavirus.

Here is a worst-case scenario: you or a family member is sick, with symptoms that are getting more severe and require going to the hospital. Due to COVID-19 rules, you aren’t allowed to have anyone come with you. You will be immediately isolated from any family, making all of this advanced planning and organization even more important. The time to prepare your documents is before the hospital visit, which is now.

Here are the 4 “must-do’s” to be prepared:

1. Make sure your estate documents are in order and reflect your current wishes. Additionally, be sure that your executor and successor trustee know where to find your documents. If your documents have not been updated in many years, make sure that the people you’ve named are still whom you want to act on your behalf. Consider making any updates to designated executors/trustees, beneficiaries or other provisions in your estate planning documents with your attorney. While you are at it, this is a good time to implement any changes due to the SECURE Act, which we wrote about here.

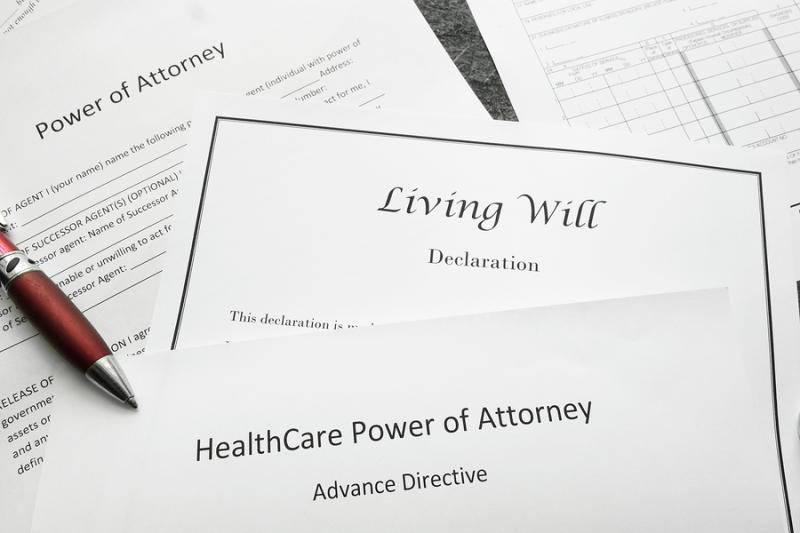

Your full estate planning considerations should include:

- Wills

- Trust documents (if applicable)

- Financial Power of Attorney

- Advance Directive/Healthcare Power of Attorney

- HIPAA Release for healthcare information

- Life Insurance Policies

- Retirement Plan Beneficiaries

- An updated net worth statement showing your various accounts and balances

Also, to be even more organized, be sure to upload any digital copies to a secure cloud storage location as long as someone else can access it without you.

2. Make sure you have your Durable Power of Attorney and Advance Healthcare Directives accessible by your nominated agents and keep a copy with you. This allows your wishes to be honored even if you are not able to convey them due to a medical condition.

3. If you have an HSA (Health Savings Account), FSA (Flex Spending Account) or other medical expense account, make sure it is funded with tax-deductible contributions and tell a loved one that it exists so that they know where to turn if you have a prolonged illness and bills come due.

4. Make sure all of your life insurance and retirement account beneficiaries are up to date and match your wishes. The beneficiaries on file determine where funds are distributed, and these types of accounts/policies are not guided by your will or trust. Also, be sure to include contingent beneficiaries wherever possible.

Thinking about our own mortality is never fun. Sadly over 80,000 people have already died from COVID-19 in the U.S. While we hope everyone is able to live a long and healthy life, it is worth taking a moment to consider what happens if we aren’t so fortunate. Many patients who survive still have prolonged bouts of severe health concerns and can be deemed “incapacitated.” Estate planning is not just about death and dying; it is also about communicating your wishes before you are incapacitated and can’t speak for yourself.

If you have questions about your estate plan or are looking to learn more about questions you can ask your estate planning attorney, please contact CCMI and we will direct you to appropriate resources.

Stay well and stay safe, and it never hurts to plan ahead.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?