Key Takeaways:

- Dexcom is a medical device company that issues restricted stock units (RSUs) to its employees, with vesting over three years and quarterly and special blackout periods.

- While Dexcom withholds taxes to cover your liability once your RSUs vest, it’s important not to assume it will fulfill your entire obligation. Be sure to understand what’s being withheld and what you actually owe to avoid tax surprises.

- Avoid the common mistake of holding by default and develop a clear sell-or-hold strategy once your RSUs vest by understanding tax implications and your cash-flow needs.

- Comprehensive financial planning and guidance from a professional can help ensure you effectively integrate your new stock into your overall financial picture, considering all factors that could affect you and your future.

California is a tech hub, home to the headquarters and major offices of companies such as Apple, RTX, and Dexcom, a medical device company. Many of these, including Dexcom, provide their employees with equity compensation, such as restricted stock units (RSUs), which add a level of financial complexity to a professional’s financial picture — something we frequently navigate as financial advisors in San Diego.

In this guide to biotech equity compensation, we’ll explore how Dexcom RSUs differ from those of other companies and how employees can manage taxes and concentration to support their overall goals.

How Do Dexcom RSUs Work?

Dexcom issues RSUs to employees at various levels, including associates, engineers, and senior management.

What is a restricted stock unit? RSUs are a form of equity compensation representing actual shares of a company’s stock. Employees gain full ownership of the shares only after satisfying predetermined criteria, such as remaining with the company for a specified period or a vesting schedule. RSUs are prevalent among a number of industries, including:

- Technology/Software

- Pharmaceuticals

- Telecommunications

- Fintech

- Healthcare

- Manufacturing

- Energy

As standard practice, the company grants an employee a number of RSUs on the grant date, which become DXCM shares upon vesting and settlement, at which point employees can sell or hold them as shareholders.

How are Dexcom RSUs unique? Dexcom has unique RSU features that may differ from other biotech companies issuing RSUs, including annual vesting. RSUs vest in equal installments over a three-year period, provided employees meet their grant date anniversaries. For example, one-third of the shares will vest on the first anniversary of the grant date, and the remaining shares will vest over the next two years. Some companies that issue RSUs have quarterly vesting over four years, which may help professionals spread their taxable income more evenly throughout the year. Annual vesting requires advanced planning to ensure you’re managing your tax liability and liquidity needs.

What Should DexCom Employees Holding RSUs Check Annually?

Annually, it’s essential for employees to review:

-

- Total Shares Across All Active Grants: From new-hire to promotion grants, you may receive multiple RSU grants during your Dexcom career, each with its own vesting schedule. Ensure you’re tracking how much you own or will soon own each year to help avoid tax surprises, trading restrictions, or overconcentration.

- Confirm Your Vesting Dates: In addition to planning for taxes and income needs, be sure to check your vesting dates if you’re considering a move. Dexcom has a strict RSU policy regarding voluntary departures and involuntary terminations, under which any unvested shares are forfeited.

- Check for Performance-Based Milestones: While Dexcom follows a three-year vesting schedule for continued employment, some of your RSUs may be performance-based and will vest only upon reaching specified milestones, if at all. Be sure to check whether there are any performance-based triggers tied to your RSUs to ensure your planning is more accurate.

What Are Dexcom’s Trading Restrictions?

Like many companies, Dexcom has built-in trading restrictions on its RSUs to help prevent insider trading and other compliance issues. Dexcom has quarterly trading blackout windows — from the 15th of the last month of the quarter until three days after the company announces its earnings — during which employees cannot sell their shares. There may be other special blackout periods for specific positions due to, for example, a merger or acquisition, or special non-public information available to you. Because RSUs can continue to vest during blackout periods, be sure to mark your calendars to better plan for taxes, income, and compliance.

How Can I Prepare for My Dexcom RSUs Vesting?

As RSUs vest annually, vested Dexcom shares often trigger larger tax events rather than smaller quarterly ones. Here are some considerations and strategies to keep in mind:

How can Dexcom employees plan for taxes and liquidity?

- Calculate your anticipated taxable income before your RSUs vest to better understand your tax implications and cash flow needs. Consider both time- and performance-based triggers tied to your RSUs.

- Understand the tax impact. Dexcom will either withhold or sell a portion of your shares to help cover taxes. However, the withholding may not fulfill your full tax responsibility. Be sure to understand what is being withheld versus your tax bracket and liability.

- Set aside necessary cash for potential taxes that may exceed what Dexcom is withholding.

- Determine your sell-or-hold strategy before trading opens.

How do Dexcom blackout periods affect selling DXCM shares?

Even if your RSUs have vested and settled, Dexcom’s quarterly and event-based blackout periods may still restrict your ability to sell your shares to help avoid insider trading. In these cases, you may need to hold stock longer than expected, which may expose you to price volatility, concentration risk, or cash flow issues.

What is a 10b5-1 Plan?

You may be able to avoid these risks by using a 10b5-1 plan. This automated strategy outlines pre-scheduled sales — based on concentration, amount, and frequency — well before any company information could be deemed insider trading. It even allows you to sell shares during company blackout windows. This can help you stay compliant, streamline your selling strategy, and better plan for taxes and cash flow.

What is the California “tax trap,” and how does it impact Dexcom RSUs?

Referred to as the California tax trap, tech professionals often have to balance California’s high taxes with the risk of underwithholding when RSUs vest, resulting in a larger-than-expected tax bill. Since RSUs are taxed as ordinary income, once vested they can push professionals into higher tax brackets. To address this, adjust your withholdings and plan RSU sales with taxes in mind.

What Actions, Timing, and Outcomes Should I Expect on Dexcom RSU Vesting Day?

Here’s what Dexcom employees can expect and consider on vesting day.

When Do Dexcom RSUs Become Company Stock?

Before vesting, your company owns and controls your granted RSUs, which are held in a “restricted” status within the plan. After vesting, the shares will undergo a settlement period to address taxes and other compliance matters. The settlement process, which is automatic with no required action on your part, can take up to 90 days from vesting (however, it usually occurs within a few days) or March 15 of the following year, whichever comes first.

Once they’ve settled, shares will be deposited into a brokerage account, like Fidelity, at which point you own them and can sell them like any stock in your portfolio, barring any trading restrictions. They’re no longer subject to forfeiture rules, and the value of the stock on vesting day is considered taxable income by the IRS.

How Does Dexcom RSU Vesting Create Taxable Income?

Once vested, the fair market value of your shares is recognized as compensation or ordinary income by the IRS and will be reported on your W-2. Think of your vested RSUs as your employer giving you a gold bar. Even if you hold the bar, you’ll still be taxed on it as income. With Dexcom’s annual vesting schedule, this means planning taxes for larger amounts of “gold bars.” This is critical to review, especially for biotech professionals, as the value could swing dramatically from the grant to the vest date.

How Does Dexcom Handle Taxes When RSUs Vest?

To address your tax liability, Dexcom will choose one of two tax withholding methods:

- Sell-to-Cover: Dexcom will automatically sell a portion of your vested shares upon delivery to cover ordinary income taxes, so employees don’t have to fund them out of pocket.

- Net Share Settlement (Company-Withheld Shares): They may also opt to withhold, not sell, a portion of your shares to fulfill your tax obligation. This will reduce the number of shares you receive.

Note that Dexcom’s withholding covers the minimum tax obligation of your vested RSUs, typically around 22%, not your total tax bill, including your full salary, bonuses, and other income sources. Without proper guidance and planning, you could underwithhold and face a higher-than-expected tax bill on vesting day. Be sure to review your upcoming vesting dates with your tax professional and financial advisor to ensure you have enough set aside, if necessary.

When and Where Will Vested Dexcom Shares Be Deposited?

Once your RSUs have vested and settled, they’ll be deposited in a brokerage account designated by Dexcom, such as Fidelity. At this point, you have full ownership and can sell, transfer, or gift the shares at your discretion. Additionally, as a Dexcom shareholder, you will gain voting and dividend rights. As with any investment in your portfolio, it’s recommended to monitor the stock’s performance, value, concentration risk, and sell or hold opportunities.

What Are Dexcom’s Material Non-Public Information (MNPI) Rules?

In addition to Dexcom’s quarterly and special blackout periods, in which you can’t sell shares, it’s essential to review its material non-public information (MNPI) rules. These rules help avoid insider trading to keep investors on a level playing field.

If you have knowledge of or access to company news that has yet to be shared with the public, such as merger and acquisition discussions, product launch delays, or any information that could affect Dexcom’s stock value, you’re likely in possession of MNPI. This means you can’t buy or sell DXCM shares, or share non-public information, until it becomes public and trading opens. Non-compliance can result in severe penalties. If in doubt, do not trade and verify your options with the compliance or legal team.

Should I Sell or Hold My Dexcom Shares?

Once your shares are vested and there are no blackout windows or trading restrictions, you can sell or hold them. Here’s what you can consider based on your financial situation:

- Selling: If you have cash needs or want to diversify away from Dexcom’s stock and decide to sell your vested shares, you can immediately lock in gains. Here’s what to keep in mind:

- If you sell immediately or shortly after vesting, you may reduce or eliminate capital gains because there is less time for the stock’s value to fluctuate.

- If you’ve held the stock for less than a year and it has appreciated, you may be subject to higher, short-term capital gains taxes if you decide to sell.

- You may consider holding the stock longer than a year to qualify for lower capital gains tax rates.

- You may miss out on any future appreciation if you had held.

- Holding: There are several reasons you may want to hold your shares. For example, you may have high confidence in Dexcom’s long-term success or anticipate their value will increase. Here’s what to remember:

- You can hold a portion and sell shares gradually. For example, you may sell a piece of the shares upon retirement, sell another portion later, and keep the remainder for the long term, provided it is less than 10–15% of your overall portfolio.

- Additionally, dollar-cost averaging involves selling small amounts of your stock over time using existing shares or new stock you receive through your RSUs that continue to vest. Spreading out your tax liability over several years may reduce the financial impact.

- You may be subject to potential price swings or significant depreciation. While RSUs retain some value as long as they’re worth more than zero, be sure to align your strategy with your risk tolerance and needs.

- Gifting: You can also gift highly appreciated stock you’ve held for over a year to charity or a donor advised fund to manage your tax liability, providing a tax deduction to help avoid built-up capital gains.

How Can I Integrate My Dexcom Shares Into My Overall Financial Strategy?

Through comprehensive financial planning, a financial advisor and tax professional can help you integrate your shares into your overall financial picture, focusing on areas such as:

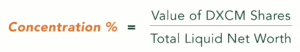

- Managing Concentration Risk: If you’re a director or higher, you may have accrued a significant amount of equity from annual and promotion grants, in addition to your salary and other options. This can increase your reliance on Dexcom’s success, affecting your personal financial security. We often recommend keeping concentration in any single stock or company between 10–15% of your total portfolio. A simple way to determine your risk is to calculate your concentration ratio:

-

-

- For example, let’s say you have $600,000 in DXCM shares and a liquid net worth of $2 million. Your Dexcom concentration is 30%, which is considered high.

- In this case, it’s worth discussing with your financial advisor how to diversify your investments to reduce risk.

- Prepare for upcoming vesting and anticipated sales by setting aside enough cash or adjusting your tax withholding to cover taxes.

- Capital gains tax is what you owe for any appreciation you’ve incurred on assets you own. For example, if the fair market value of your RSUs on vesting day was $30/share, that’s your cost basis (or original “purchase” price). If you sell them later for $40/share, you will have $10 in capital gains per share. With planning, you can weigh the pros and cons of selling versus holding, and determine the best way to manage your tax liability.

-

- Grant Agreement: This document outlines the terms and vesting schedule of your RSUs, as well as what happens if you leave the company, if the company is acquired, and in other situations.

- Confirmation: Once your RSUs vest, you will receive a document confirming the vesting date and the fair market value, both of which are important for calculating and planning for capital gains.

- Tax Planning: Remember RSUs are taxed twice: once when they vest as ordinary income and again when they’re sold as capital gains.

- Tax Statements: Documents such as your W-2 and brokerage statements confirm income was reported, support future tax planning, and help avoid double taxation. Double taxation can occur when you sell your shares and the original cost basis is missing or inaccurate. This error makes it appear that the total amount is taxable when it should reflect that you already paid taxes at vesting. This could result in paying taxes twice, rather than only on your post-vesting gains. Meticulous recordkeeping can help avoid this issue.

- Using a 110b5-1 Plan: If you question whether to sell, hold, or avoid concentration without violating insider trading policies, you can also use the previously mentioned 10b5-1 plan, which pre-schedules trading based on defined criteria.

What Dexcom Records or Forms Should I Keep?

Keeping your RSU paperwork organized is a simple way to avoid costly mistakes and reduce tax-planning stress. Here are three documents you should save following a grant that you can access through your Fidelity NetBenefits dashboard:

- Grant Agreement: This document outlines the terms and vesting schedule of your RSUs, as well as what happens if you leave the company, if the company is acquired, and in other situations.

- Confirmation: Once your RSUs vest, you will receive a document confirming the vesting date and the fair market value, both of which are important for calculating and planning for capital gains.

- Tax Statements: Documents such as your W-2 and brokerage statements confirm income was reported, support future tax planning, and help avoid double taxation. Double taxation can occur when you sell your shares and the original cost basis is missing or inaccurate. This error makes it appear that the total amount is taxable when it should reflect that you already paid taxes at vesting. This could result in paying taxes twice, rather than only on your post-vesting gains. Meticulous recordkeeping can help avoid this issue.

What Are Common Dexcom RSU Missteps to Avoid?

Working with biotech executives and professionals, we often see common RSU mistakes. From missed opportunities to poor planning and misunderstandings, referencing this guide can be a helpful first step in avoiding mistakes, such as:

- Underwithholding Taxes: While Dexcom typically withholds around 22% for taxes, per IRS guidelines, it does not consider your total tax bill and may not be sufficient if you’re a higher earner. Increased taxable income and taxes from capital gains can leave you with a massive, unexpected tax bill. As the vesting and selling windows approach, ensure you’re well-prepared to manage taxes.

- Believing in the Pipeline as a Diversification Strategy: Employees who are confident in Dexcom’s trajectory may unintentionally justify holding more of the company’s stock. While you may feel confident and familiar with Dexcom, true diversification comes from spreading your exposure across industries, stocks, and companies rather than relying on a single one.

- Not Having a Clear Sell or Hold Strategy: With automatic vesting, blackout periods, overlapping vesting dates, and tax implications, if you don’t have a predetermined selling strategy, it’s easy to delay action and unintentionally allow stock to accumulate. Without a selling strategy, holding becomes the default, which can lead to missed opportunities or selling when the stock’s value is down. To avoid this, develop a selling strategy — even if it won’t occur right away — by evaluating taxes, concentration risk, and cash flow with a professional to determine your next steps.

- Treating DXCM as a “Blue-Chip” Stock: Blue-chip investments are stocks of established, lower-risk companies that have consistently performed well and are considered steady, stable investments, such as Google or Nike. While Dexcom is a strong company, it’s critical for employees to be discerning when treating it as a blue chip. As your job and salary are already tied to the company, increasing your concentration through additional investments can put your long-term personal finances at risk. Why? Dexcom remains subject to factors such as product trials and regulatory approvals, which can make its stock price volatile and unpredictable. It’s essential to manage your stock effectively so you’re sufficiently diversified to mitigate against big swings.

Dexcom Equity Strategy: How Do You Plan, Protect, and Grow Your RSU Holdings?

While vesting occurs on a single day, strategic planning begins long before. There are critical actions to take before, during, and after your Dexcom RSUs vest to help ensure you’re maximizing your income, mitigating taxes, and reducing your risk. As we’ve mentioned, it’s essential to manage your RSUs at every phase, including:

- Before Vesting: Review your tax bracket, projected taxable income, required liquidity, and cash flow needs.

- During Vesting: With thoughtful planning and preparation, strive to stick to your predetermined sell-or-hold strategy.

- After Vesting: Continue to monitor your concentration risk and tax implications and consult a professional about diversification and other savings strategies to support your goals.

At CCMI, we understand the biotech industry and specialize in equity compensation services to help you make informed decisions at every stage. Ready to turn your Dexcom equity into a long-term wealth engine? Contact us and speak with a San Diego-based fee-only advisor today.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?