As financial advisors in San Diego, with its numerous large corporations, biotech startups, and healthcare companies, we often see business owners and executives holding restricted stock units (RSUs), a form of equity compensation. Their unique structure offers employees a tangible stake in the company’s success, aligning their interests with those of the company.

RSUs can create an added level of financial complexity, requiring advanced tax planning and special considerations to be managed effectively. If you hold RSUs or are in an industry that grants them, let’s dive into what they are, how they work, and potential impacts to your tax liability and net worth.

What is a Restricted Stock Unit (RSU)?

RSUs are a form of equity compensation, representing actual shares of a company’s stock. Here are some features of RSUs:

- No Purchase Required: Unlike other company stock options, there is no initial investment or purchase required by employees; instead, employers grant RSUs to employees.

- Ownership and Vesting: Employees gain full ownership of the shares only after satisfying predetermined criteria, such as remaining with the company for a specified period or a vesting schedule.

- Value Retention: RSUs carry value at the fair market price, only once vested, at which point employees can sell or hold the shares as regular shareholders. Unlike stock options that could put employees “underwater,” if the stock price falls below the designated exercise price, RSUs retain some value unless the stock goes to zero.

- Employees Have “Skin in the Game”: With ownership tied to performance goals, a vesting schedule, or other factors, the approach can foster employee retention and motivate employees to actively contribute to the company’s success, growth, and stock value.

- Volatility and Turnover: Since RSUs retain value even if the stock price fluctuates, and vesting requires employees to stay with a company for multiple years, RSUs are particularly popular among industries or startups with high volatility/turnover or fewer resources, such as technology, biotech, healthcare, and pharmaceuticals.

How Do RSUs Work?

The mechanics of RSUs make them increasingly attractive to startups and companies in industries such as biotech, which often have smaller salary budgets and longer research and development timelines, and need to engage talent for longer periods, often through volatile or high-risk periods. Here is how RSUs work:

- Grant Date: On your grant date, your employer awards you a specified amount of RSUs, which don’t yet hold value but are a commitment based on specific criteria.

- Vesting Schedule: You earn RSUs upon fulfilling the criteria outlined in the vesting schedule. Vesting criteria may be time-bound, performance-based, or a combination of both. For example, a biotech company conducting lengthy clinical trials may have vesting criteria like:

- Employees will receive a percentage of their shares over four years, and the remaining portion of shares will vest upon reaching a milestone, such as regulatory approval.

- Delivery of Shares: Once vested, the employee owns the shares outright at the current fair market price, which will be taxed as ordinary income. Employees can then sell or hold the shares as regular shareholders.

How Are RSUs Taxed?

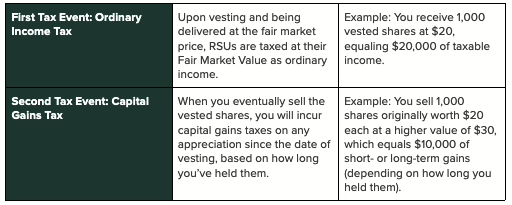

RSUs are taxed twice — when they vest and again when they’re sold.

Here are other RSU tax considerations:

- In some cases, companies may have a “sell-to-cover” feature, which will automatically sell a portion of your vested shares upon delivery to cover ordinary income taxes so there are no additional expenses on your part.

- It’s essential to set aside money to manage taxes at vesting if “sell-to-cover” isn’t available or when you sell your shares to pay taxes.

- We suggest working with a financial advisor to discuss your options and develop a strategy that helps minimize your tax liability before your RSUs vest or you plan to sell.

When Can I Sell My RSUs?

You have the option to sell your RSUs once they have vested and you own them, barring any company restrictions. Deciding when to sell your RSU shares depends on your financial situation and other factors, including:

- Company Restrictions: Even if your shares have vested, your company may have trading blackout windows or other clearance periods before you can actually sell them. This is typically done to comply with insider trading policies.

- For example, let’s say you work for a biotech company, and your RSUs vest on March 1, but your company will announce its earnings on March 10. In this case, they may implement a blackout period around the announcement.

- Cash Needs: If you need immediate cash, selling vested RSUs can provide liquidity, as required.

- Confidence in Your Company: If you’d like to participate in your company’s long-term growth or anticipate its value will increase, you may consider selling your RSUs gradually. One strategy we’ve shared with clients is to sell a piece of the shares upon retirement, sell another portion later, and keep the remainder for the long term, provided it is less than 10–15% of your overall portfolio.

- Tax Implications:

- You may consider holding the stock longer to qualify for lower capital gains tax rates, as shares held less than a year will trigger higher short-term capital gains taxes.

- Additionally, dollar-cost averaging involves selling small amounts of your stock over time using existing shares or new stock you receive through your RSUs that continue to vest. Spreading out your tax liability over several years may reduce the financial impact.

- You can also gift highly appreciated stock you’ve held for over a year to charity to manage your tax liability, providing a tax deduction to help avoid built-up capital gains.

- Concentration Risks: You may find a significant portion of your net worth is tied to RSUs, which can be overly reliant on your company’s performance. If so, you may sell a portion to diversify to spread risk across different asset classes or hedge your exposure to minimize potential financial risks and protect against price movements that could have a negative impact.

Understand Your RSUs. Optimize Your Taxes. Secure Your Future.

RSUs are a valuable form of equity compensation, but they require a plan to manage them effectively. We suggest seeking personalized advice and services tailored to your specific financial situation.

Speaking with a financial planner who specializes in RSUs and equity compensation and has experience with various company structures can provide valuable insights to inform your decisions. At CCMI, we help you assess your unique situation, understand the nuances of your RSU agreement, and develop custom plans that align with your goals and risk tolerance. We can also guide you in:

- Managing RSUs after you’ve left your company

- Considerations for privately held companies

- Balanced and strategic diversification to manage overconcentration

- Tax-efficient planning, including strategies like tax-loss harvesting

Contact us to learn more about how we can help you optimize the long-term value of your RSUs, addressing concentration risks, balance, and taxes.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?