New Year’s resolutions to eat healthy or learn a new skill may come around once a year but there are some habits worth picking up anytime — especially when it comes to your financial future. As a young professional, thinking ahead to retirement planning, there are key financial areas you should keep on your radar year-round that will significantly impact how you retire. While that day may seem far off, the time you have on your side now is your greatest asset and precisely why early planning matters. Let’s review three key steps you can take today to position yourself for long-term security.

#1 Start Investing

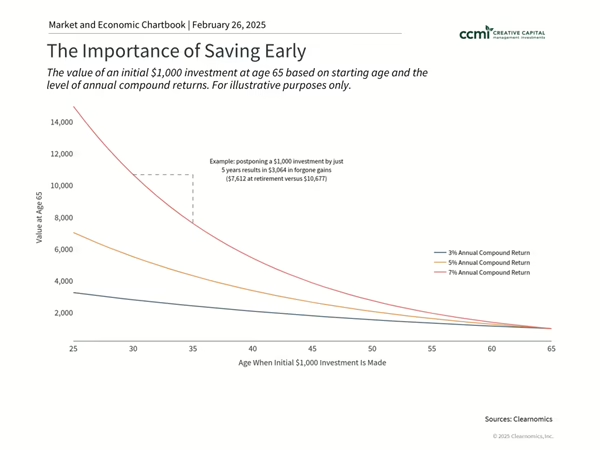

You may have put off investing due to market or risk concerns. However, long-term investing is an essential component of creating significant wealth by the time you retire. The power of compound returns, which are reinvested over decades, is a primary benefit of investing and staying in the market long term, even with small contributions. For example, look what a difference waiting even a few years can have on an investor’s overall savings:

Understanding market activity and long-term opportunities is essential to keeping a level head as an investor. We encourage you to discuss trends and personal concerns about investing with a professional to learn how investing early can benefit your retirement.

#2 Review Your Retirement Accounts

If you don’t have a defined benefit plan guaranteeing a payment amount in retirement, you must change how you plan for retirement. Defined contribution plans, like 401(k)s and 403(b)s, are increasingly common, making it more critical than ever for plan participants to take personal responsibility in reviewing their accounts and implementing personalized strategies, such as:

- Which account types are appropriate for your circumstances?

- Which investments enhance tax efficiency?

- Are you maximizing your contributions, given your current needs or employer match?

While having various options may feel overwhelming, there are also more opportunities to personalize your plan. Consult an advisor to navigate various scenarios and identify the best strategies for you.

#3 Plan for an Extended Retirement

People are living longer, which is a positive new development (see image) and a critical consideration in retirement planning. Pre-retirees must have sufficiently funded plans that continue to generate income to avoid running out of money in retirement due to longer lifespans, healthcare costs, inflation, and other factors — known as longevity risk.

Beginning a healthy financial planning strategy now is paramount to ensuring you have enough saved, can adapt to new needs, and ultimately enjoy a comfortable retirement — which could last 30 years or longer. An advisor can help you forecast hypothetical situations, plan for healthcare in retirement and the cost of assisted living, and determine strategies and withdrawal rates to support your future needs.

Retirement Planning for Young Professionals: How CCMI Helps

It’s never too early to begin planning for retirement, and our team is here to guide you on your journey. We often guide young professionals and clients across life stages, including financial planning for growing families, tax-efficient strategies, withdrawal plans, and asset allocation and protection to help keep more of their wealth. Contact us if you’d like to get started.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?