With political elections more polarized in recent years, it’s understandable some investors might feel uneasy about how the 2024 presidential outcome will impact their portfolio. Allowing headlines and campaign promises to sway our financial decisions can be tempting. In the midst of this 2024 election season, we’ve had many conversations with clients who share these concerns. As an objective financial partner, we want to provide clarity backed by evidence-based research about commonly held perceptions of the connection between elections and financial markets. Our greatest takeaway? Vote at the ballot box this November — not with your portfolio. Let’s discuss why this approach can bring you peace of mind.

Presidencies and the Economy

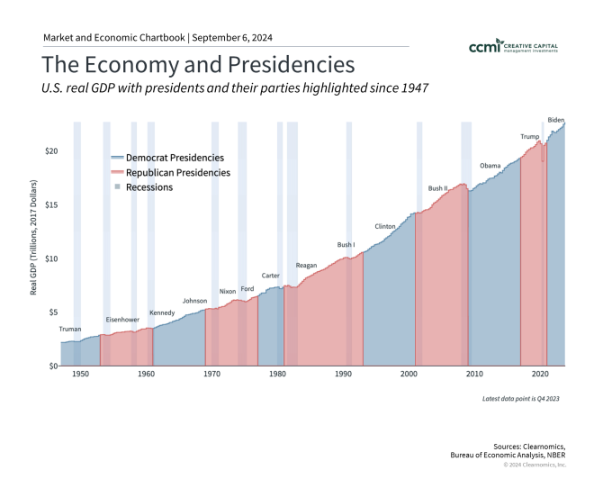

During election years, the economy often takes center stage, with both sides of the aisle promising their plans will dramatically improve our financial futures. While tax bills and industry regulations certainly influence our day-to-day lives, decades of data suggest presidents often receive too much credit (or blame) for long-term economic conditions. Separating personal views from objective patterns, the true drivers of long-term economic performance are the underlying business cycle trends, which are far more powerful and long-lasting than any single administration’s policies. These cycles, shaped by global events, market forces, and innovation, ultimately drive investment returns and wealth creation.

This is important to consider when making investment decisions. For example, take a look at this example illustrating what would happen if an investor only invested while a specific party was in control of the White House:

There appears to be a winning strategy, right? However, see below for what would happen if an investor stayed invested regardless of who was in control. This highlights the importance of staying invested through all market cycles rather than letting politics steer your decisions.

There appears to be a winning strategy, right? However, see below for what would happen if an investor stayed invested regardless of who was in control. This highlights the importance of staying invested through all market cycles rather than letting politics steer your decisions.

Additionally, when we review the level of the country’s gross domestic product (a measure of the size of the economy) since World War II, with dozens of business cycles, downturns, and recessions — including the recent pandemic crash, the 2008 global financial crisis, and the 2000 dot-com bust — there is still steady growth across both political parties. These events were driven by external factors like globalization and the information technology revolution, not by which party was in control.

How Campaigns Appeal to Consumers

With heightened emotions and financial squeeze many Americans have felt in recent years, it’s natural to want to prioritize economic policy when choosing a presidential candidate. Still, having context for the broader picture is important. While economic policies matter, a single election or policy often has far less influence on the economy than voters may think.

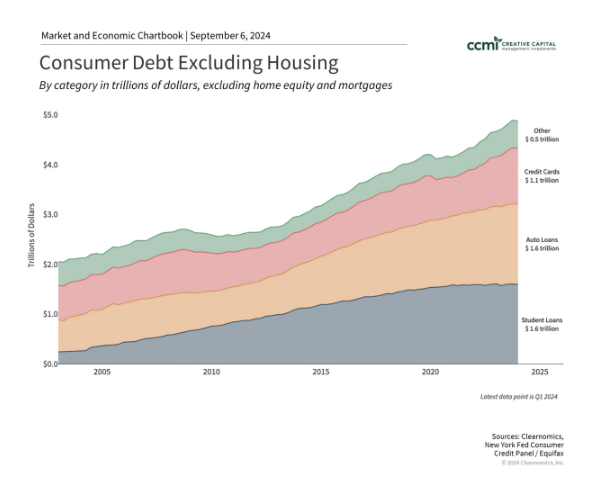

It may be surprising but the economy generally shapes elections, not the other way around. Why? Candidates tend to highlight the financial hardships Americans have experienced in recent years. While inflation has eased and the economy is strong in many areas, many Americans still grapple with rising consumer debt, from credit cards to student loans (see below).

While the candidates differ in their approaches, there are broad similarities across their economic proposals, focusing on housing, cost of living, and expanding the child tax credit. Given these challenges, it makes sense that both candidates are speaking to those who feel “left behind,” hoping to resonate with their concerns and influence their votes.

Presidencies and Taxes

Taxes are another hot-button issue among voters, with both candidates proposing vastly different strategies. For example, former President Trump favors extending his administration’s tax cuts and potentially lowering corporate tax rates. At the same time, Vice President Harris has focused mostly on tax credits for middle and lower-income Americans. As always, context is important.

While significant, taxes are more likely to directly impact Americans and companies than the economy and stock market. Taxes are only one component that affects growth and returns, and several strategies are available to reduce taxes through credits, spending, and more. Importantly, lower taxes don’t automatically mean economic growth, and the reverse is also true.

Despite the perceived differences between the two parties, many policies often stay in place, even as administrations change. Because of checks and balances in Congress, changes that occur tend to be incremental. Additionally, new proposals often face obstacles and may not materialize — even when the president’s party also controls Congress. For example, the Reagan-era tax cuts and Trump administration’s tariffs have remained in place across administrations despite political parties.

Still, it will come down to higher tax rates or economic growth to pay for these proposed credits and cuts. Unfortunately, since government spending tends only to rise, recent history shows the likely result will be higher government debt. Higher tax rates are also a concern among many investors, especially because individual tax rates are still relatively low by historical standards. This complexity makes proper tax planning essential, ideally with the help of a trusted advisor, as investors look toward the future.

A Focus on Long-Term Goals

Given the constant media flow, feeling nervous about the upcoming election is natural. However, objective research shows a president’s influence on the economy and markets is often less significant than many believe — a reminder that political uncertainty is fleeting but the power of a long-term financial perspective remains constant. To be clear, there have always been some market reactions and short-term volatility as we approach and undergo election season. However, analysts and investors have also found ways to adapt to fluctuations and changes in political office.

Understanding this context can help you look beyond the rhetoric and focus on what truly impacts your future. We encourage you to work with a professional to address your concerns and develop an adaptable, long-term plan tailored to your and your family’s unique goals and situation, no matter what political changes may come. Our team is here to support you if you have questions about how the upcoming election could affect your financial plans. Contact us anytime.

Sources:

(1) Emotional Rescue: Markets, Fed Policy, and Elections

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at https://myccmi.com/important-disclosures/

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?