Whether approaching retirement or not yet ready to retire, all entrepreneurs reach a juncture where they ask, “Should I sell my business?” We often guide San Diego business owners in the decision-making process as they work to increase the value of their company, anticipate the right time to sell, and assess market readiness. Exiting your business is a significant event, prompting additional questions you should frequently evaluate long before reaching retirement age. Let’s start by discussing signs it may be time to sell.

Signs It Might Be Time to Sell or Exit Your Business

Some situations may prompt you to consider selling or exiting your business, such as:

-

- Your Business Is Profitable: Selling while your business is successful may attract potential buyers and increase its value.

- You’ve Received an Offer: A purchase offer verifies market demand and provides funds to pursue other investments or interests.

- You’re Burnt Out: Exhaustion or partner disagreements may signal it’s time to leverage your skills elsewhere or introduce new leadership.

- There’s Too Much Risk: Selling may reduce risk related to market uncertainties, downward trends, or other circumstances, protecting your assets and future security.

- You’re Approaching Retirement: You’re ready to sell your business to support your next chapter and legacy.

- You’re Experiencing Personal Life Changes: If your priorities have changed due to health issues or family obligations, you may wish to sell your business to free up time and resources.

The Successful Business Exit Mindset

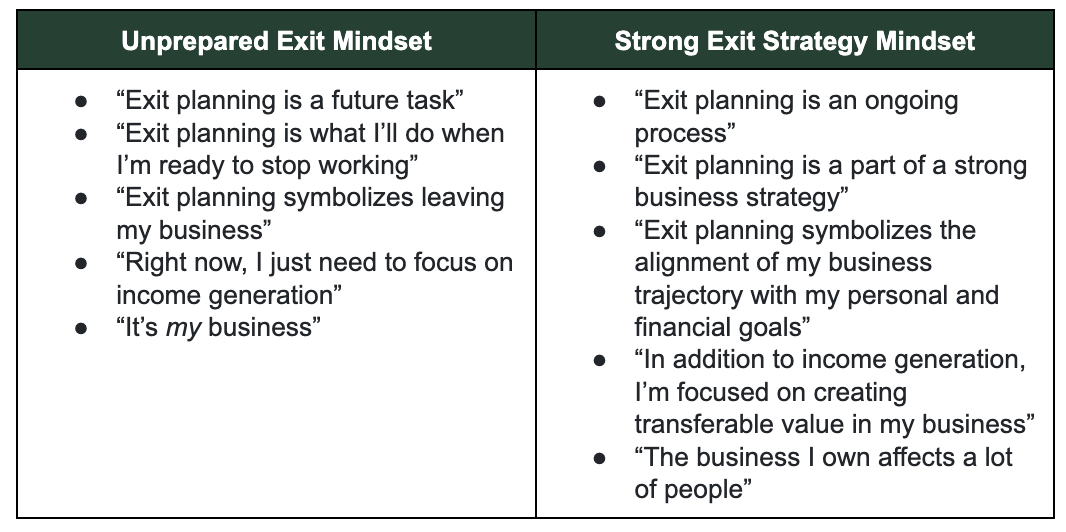

Mindset is crucial. Despite feeling ready to exit, the process often encounters obstacles. Why? Many business owners fail to align business goals with personal and financial goals, viewing exit planning as a distant event. Without a clearly defined plan, business owners may face undue complexity or later regret their decision to sell.

We often refer to Christopher Snider’s book, Walking to Destiny, which defines exit planning as a combination of turning “the plan, concept, effort, and process into a clear, simple strategy to build a business that is transferable through strong human, structural, customer, and social capital. The future of you, your family, and your business are addressed by exit planning through creating value today.” This definition emphasizes that exit planning is strongest when the owner evolves their mindset from a “point-in-time approach” to a dynamic process and prepares for an eventual exit.

At CCMI, we’ve encountered a range of client mindsets contributing to strong and unprepared exit strategies, illustrated below.

A key point as you explore your exit-planning mindset is that the successful mindset will allow you more freedom to choose whether to grow or exit continually rather than only getting one shot at the exit strategy. If you start with this simple paradigm shift for exit planning (especially if it hasn’t been on your mind), you will likely be better prepared for your eventual exit while building your business.

Are You Ready to Exit Your Business? Questions to Consider

Snider suggests revisiting the decision to grow or exit every 90 days, bringing the choice into the present and informing your actions. If you decide to sell, you may find the path you thought you would take isn’t available or as attractive as you explore your exit options. Let’s review key questions to help determine if you’re ready for a sale.

Do You Understand the Business Transition Process?

Transitioning from your business is a comprehensive, multi-step process that begins long before the actual exit. There are three distinct stages:

- Pre-Transition: The initial phase requires careful consideration of how to make your company transferable and attractive to potential buyers.

- Transition: Once you decide to sell, you should prepare for a multi-year implementation timeline. This involves establishing clearly defined goals, defining tasks, assembling a team, appointing a project manager, setting timelines, and developing a budget.

- Post-Transition: Following a sale, the focus is on transitioning ownership and leadership, communicating changes, and addressing retirement or personal planning needs.

Do You Have an Advisory Team?

Having a professional team is crucial for effective exit planning. The team should include a CERTIFIED FINANCIAL PLANNER™ professional, an M&A and estate planning attorney, a CPA, a banker or investment banker, board members, family, and other stakeholders. Depending on your company or preferred approach, other specialists may also need to be involved. Here are some other things to keep in mind:

- Engage Early: Engaging a financial advisor as early as possible may provide additional value and options and inform your decisions as you navigate your business, personal objectives, and exit.

- Ensure Professional Oversight: We suggest partnering with an advisor before accepting sale offers or signing agreements to avoid missed savings, unforeseen tax consequences, or not capturing enough funds to reach retirement goals.

- Consider Specialized Expertise: Understanding the business owner’s lifecycle, a Certified Exit Planning Advisor (CEPA) specializes in helping business owners maximize value, minimize taxes, and navigate the transition from owner to retiree.

- Plan for Retirement: We recommend consulting with a retirement planning professional at least five or six years before your target retirement date to assess your situation and business value and explore suitable strategies.

Do You Have a Current Business Valuation?

Before going to market, ensure you clearly understand your company’s value using a business valuation or other means. Business value is calculated based on a fairly simple formula:

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) x Multiple (of tangible and intangible assets) = Value

We also recommend conducting a personal and financial assessment to gauge your readiness and identify any gaps you can proactively manage. This assessment includes the business value, your personal financial needs, and plans for the future — collectively referred to as the triggering event. A triggering event identifies critical business gaps, actions to mitigate risk, and strategies to enhance business value and transferability. Even if you don’t plan to transfer the business soon, addressing these issues can help your business perform better without you.

Let’s take a look at the three types of gaps you should be aware of in your business and proactively manage if you want to accelerate the value of your business prior to a sale:

- Value Gap: The value gap is the difference between the company’s current value and the maximum value best-in-class companies in the same industry receive upon sale. By positioning your company as best-in-class, you can accelerate its value and potentially get a higher valuation upon exiting.

- Profit Gap: The profit gap is the difference between your company’s reported profits and those of best-in-class companies in your industry. Addressing this gap can increase profitability and result in a higher multiple upon your exit.

- Wealth Gap: If a significant portion of your net worth is tied up in the business, understanding the wealth gap — how much you need to sell your business to reach your financial goals — is crucial for personal financial planning.

Have You Reviewed the Pros and Cons of Your Exit Options?

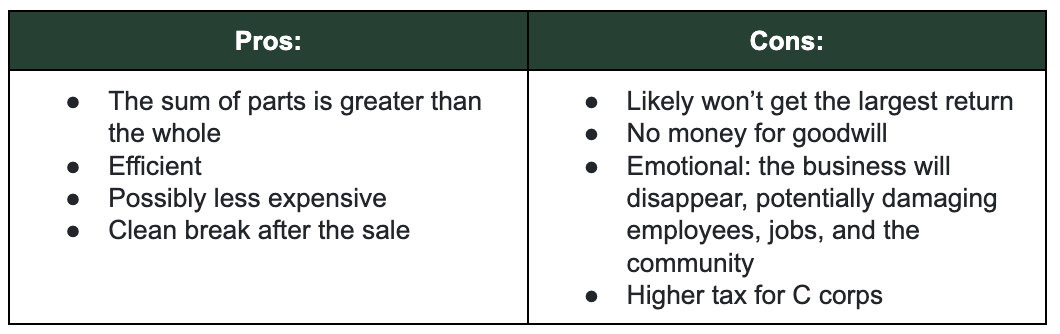

Business exits typically fall into eight internal or external categories. If you decide to sell, it will likely take time and commitment to do it right. Understanding the pros and cons of each option is essential when choosing which one may be right for your company.

Internal Exit Options

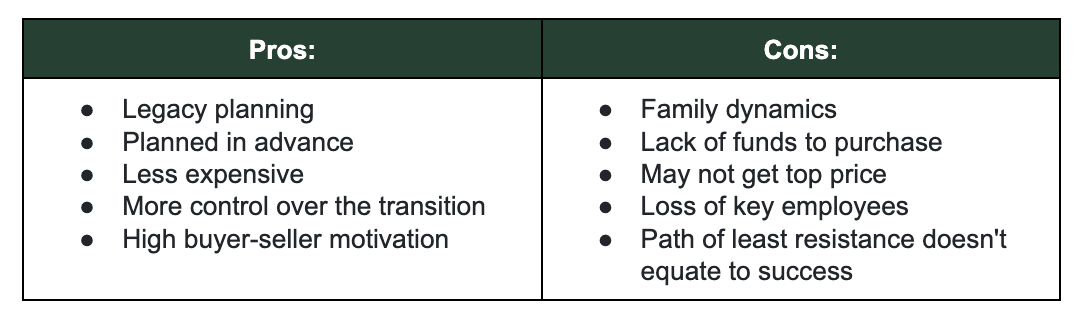

– Intergenerational Transfer: This is a top choice for many business owners, as many dream of passing their business on to a family member.

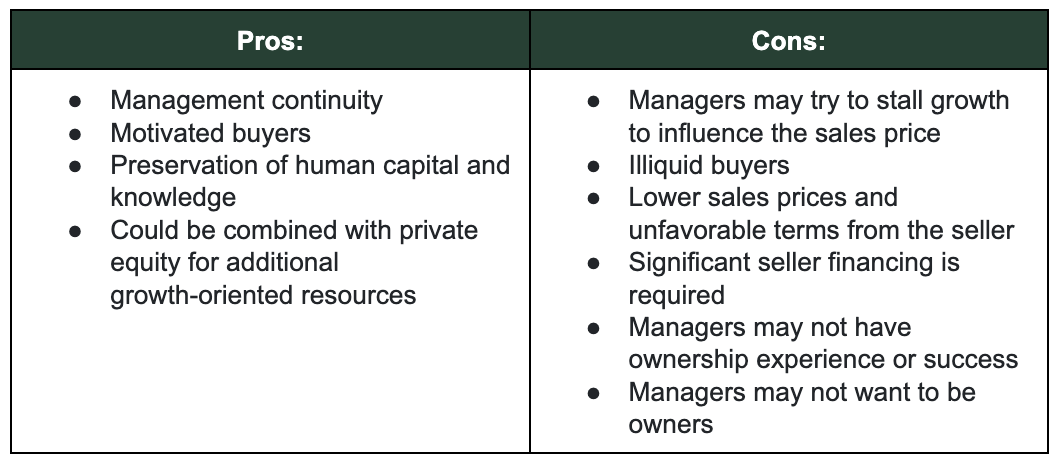

– Management Buyout: The business owner sells all or part of the business to key employees or managers, trusting they can continue to grow it. However, management must use the business’s assets to finance much of the purchase price.

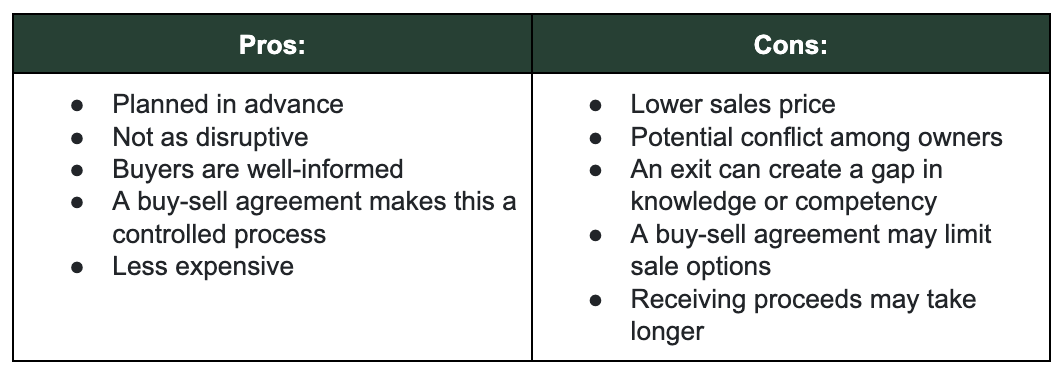

– Sale to Existing Partners: This option doesn’t work for single-owner businesses but may be a requirement of a multi-owner firm with an existing buy-sell agreement.

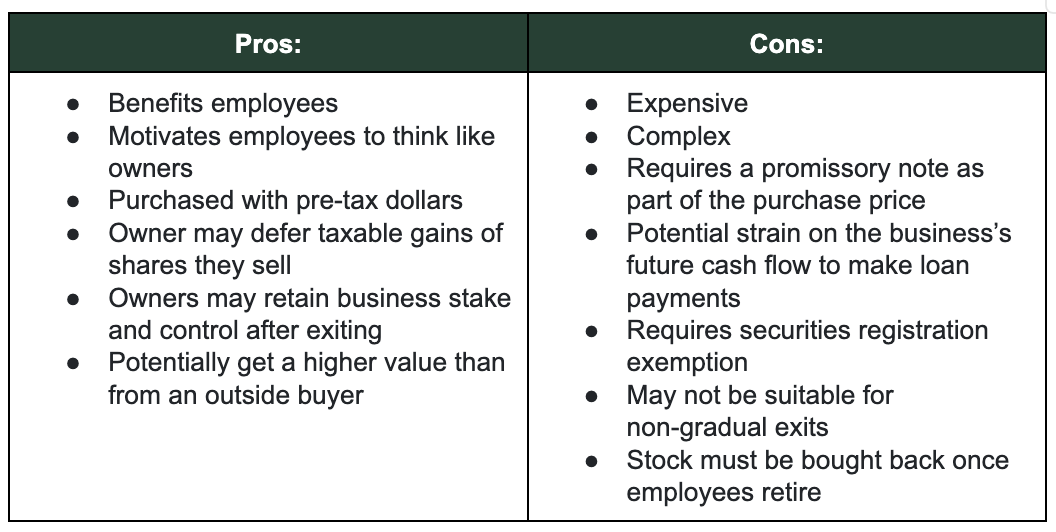

– Employee Stock Ownership Plan (ESOP): An ESOP is a qualified contribution benefit plan for employees primarily investing in the sponsoring employer’s stock. The company must borrow funds to buy the shares from the owner, which are held in a trust on behalf of the company employees.

External Exit Options

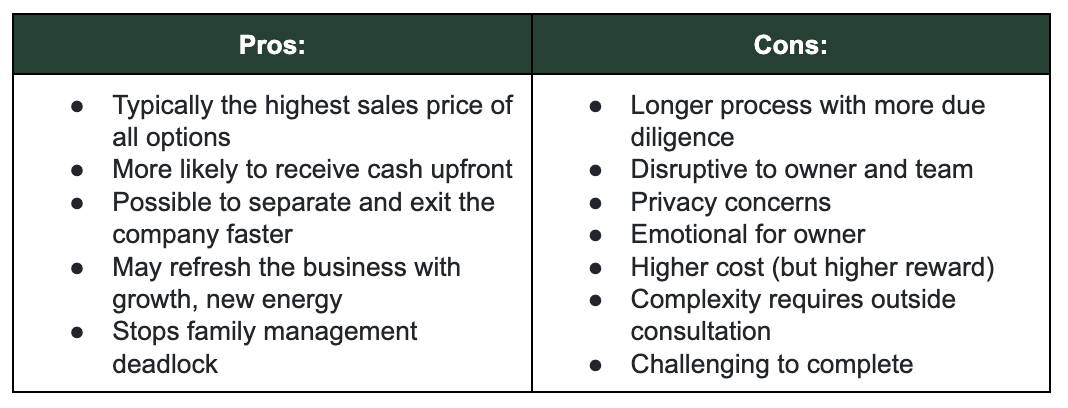

- Sale to Third Party: The transaction may include a full or partial sale for liquidity to a strategic buyer, financial buyer, or private equity group. The sales process may be negotiated, a controlled auction, or an unsolicited offer.

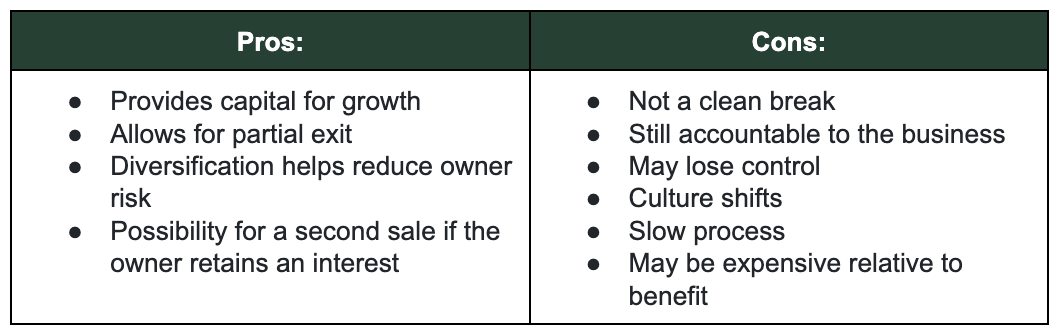

- Recapitalization: In this type of sale, a lender or equity investor adds capital to fund the company’s balance sheet and acts as a new partner in the business with a minority or majority interest.

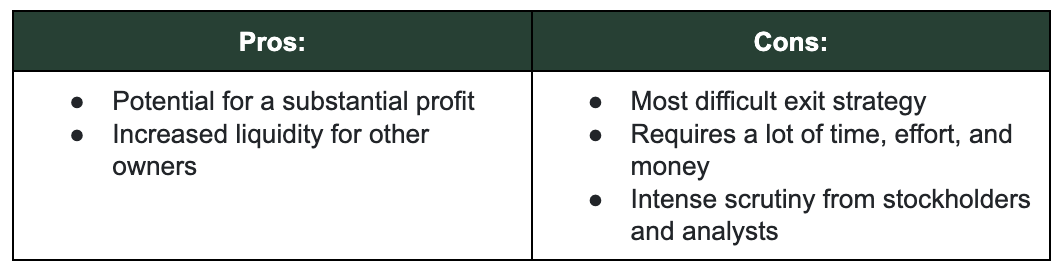

- Initial Public Offering (IPO): An IPO allows you to sell your business to the public for a potential profit. Successful IPOs are challenging and rare. This option is not realistically available to most small and middle-market companies.

- Orderly Liquidation: This is the quickest process to close the business if the asset values exceed the ability of the company to produce the income required to support an investment. It is also the most final, requiring selling all assets and shutting down the business.

Do You Have a Pre-Transition Process?

A pre-transition process may include enhancing the business’s value, minimizing taxes, and planning for a smooth transition for all stakeholders, including family.

Enhancing Business Value

When making decisions such as hiring, purchasing new equipment, or investing, always ask, “How does this add value to the company?”

Successful business owners have focused on systems, processes, recurring revenue, and intellectual capital, making their companies more attractive for sale. Considering the company size, industry, and market circumstances, industry-specific multiples determine business value. While you can’t control these multiples, you can help your business trade higher by focusing on actions like improving intellectual capital and reducing risks.

Evaluating decisions based on their contribution to business value and adopting value-focused metrics can help create a culture that embraces value thinking and ensures business value is as important as business income.

Minimizing Taxes

Proactive planning as a business owner is critical for a seamless sale process and specific tax strategies. Delaying your planning may limit your tax options, delay your retirement plans, and negatively affect your business’s value.

There are ways to structure asset or ownership transfers that provide different benefits and may minimize tax implications. For example, a family business planning an intergenerational transfer might consider a self-canceling note or intentionally defective grantor trust to reduce estate taxes.

Others may want to defer capital gains or reduce federal and state taxes, implementing agreement terms accordingly. Tax, legal, and financial advisors can help outline your options and explain their consequences and benefits to determine your path.

Stakeholders and Family Considerations

Business exits are a significant change that can be emotional and sensitive, so involving key stakeholders and family members in your exit plan is critical for a smooth transition process.

Early involvement in planning and decision-making can minimize disruptions to operations, preserve relationships, and enable sufficient time for training and setting expectations for a seamless handover when the time comes.

Will the Sale Cover Your Expenses and Lifestyle?

At CCMI, we assist business owners in establishing their personal financial plans, addressing income requirements, risk management, cash flow in retirement, gifting to children or charity, long-term healthcare, and estate planning. Questions to consider include:

- Considering the after-tax amount of the sale, what is the minimum sale amount required to be financially independent in retirement?

- Can I achieve my personal objectives without relying on business income?

- What are my needs and desired lifestyle?

These aspects will help determine how much you need to save during your working years or how much you need to sell to achieve your retirement goals. Consider structuring the deal strategically; for example, spreading a sale over multiple years rather than one may lower your tax bracket, putting more money in your pocket in the long run.

Do You Have Contingency Plans for the 5 Ds?

It’s helpful to create contingency plans for each of the 5 Ds (death, disability, divorce, disagreement, and distress).

Death:

- Do you have a will and trust outlining the transfer of your business ownership?

- Is there a buy-sell agreement with business partners backed by life insurance?

- Is there a contingency plan for business continuity in your absence?

- Can your spouse or heirs run the business and gain access to necessary financial information?

- Can the business maintain its current operational capacity without you?

Disability

- Are there plans if you become disabled or unable to work due to your own disability or caregiving responsibilities?

- Does your family know your wishes for the business if you cannot communicate?

- Can key team members access and continue paying bills, working with vendors, and managing operations?

- Does your disability trigger a buy-sell agreement, even if it’s temporary?

Divorce

- Could your ownership be divided in a divorce?

- Does your buy-sell agreement force you to sell your interest in the company upon divorce?

- How are your shares valued in the divorce?

- Will the divorce impact your potential cash flow from the business?

- Will a divorce place greater demands on your personal income and stress the business?

Disagreement

- If you and your business partner can no longer work together, who leaves and what are the terms?

Distress

- What happens if the business is sued?

- What happens if a pandemic forces business closure?

- What is the contingency to recover from ransomware or a serious system hack?

Have You Considered Life After Business Ownership?

From CCMI’s experience, in addition to financial planning, thinking about life after business ownership is the most overlooked area for owners who focus on growing or maintaining their business. Post-career life questions to consider include:

- Who will I spend my time with?

- What is my purpose when I’m no longer growing a business?

- How will I identify myself if I am no longer a business owner?

- What will I do with my time?

Successfully answering these questions will give you a greater chance of enjoying a positive transition. If you cannot answer most of these questions, continuing to grow your business may be the best choice while you prepare your exit plan.

How CCMI Can Help Business Owners Exit

CCMI is here to help you evaluate how your personal finances and future life fit into your exit plan. Contact our team to learn how we can help you prepare for a future exit from your business.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at https://myccmi.com/important-disclosures/

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?