Meet Adam and Elizabeth

Adam and Elizabeth are a married couple in their early 40s who live in California with two young children under age five. Both work full time, Adam in tech and Elizabeth in healthcare. The couple, whose income and benefits total approximately $500,000, is relatively financially sophisticated and practical in their spending and budgeting. However, as they progressed in their careers and began earning higher salaries and executive benefits, such as stock options, they knew they needed guidance on optimizing their assets, primarily as they worked toward a big goal of buying their first home.

The Challenges

With both working high-pressure jobs and taking care of two young children, these young professionals were overloaded and their do-it-yourself approach to their finances was getting too complex.

They conservatively saved in their bank account, rented while they accumulated funds for a house, and established a California 529 college savings plan for their kids. With recent pay increases and solid career paths, their goal to buy the home their kids would grow up in came into focus.

Adam receives restricted stock options and participates in his employee stock purchase plan (ESPP). The couple knew their shares were valuable, as the company’s stock had performed well recently, but they didn’t know how to use them for their short- and long-term goals or the type of tax consequences that might follow.

The couple didn’t currently have a financial advisor to guide them or a distinct roadmap that tracked their progress and laid out their goals. Further, with a DIY approach, they understood they could be missing valuable opportunities to save, reduce their tax burden, or fit in other goals, such as paying for their kids’ college expenses.

How We Helped

Meeting with the couple, we made an immediate connection, having helped several other young professionals and growing families with similar financial concerns. They appreciated our firm’s boutique, personalized experience, and attention to the various aspects of their lives, including ones they had yet to consider, that would help them mitigate risk and reach their short- and long-term goals. Our comprehensive approach allowed the couple to delegate their finances with more peace of mind, knowing we would monitor their progress, make appropriate adjustments, and plan for the unexpected while they focused on their family, careers, and meeting significant milestones. Here’s how we helped them develop a multipronged financial roadmap:

- Timing Stock Purchases and Sales

- The couple planned to purchase a home within the next two years, giving our team time to plan stock sales and allowing us to spread the tax burden over that timeframe. This was essential as the stock value continued to increase and perform well while providing them with additional funds for their house purchase.

- Additionally, we helped them time their ESPP contributions, suggesting they participate and sell after a year. This approach allowed the couple to benefit from the employee stock discount and earn long-term capital gains, further improving their tax and house-fund positions.

- Optimizing Savings and Retirement Contributions

- We made necessary changes to their 401(k)s and suggested a mega backdoor Roth, a tax strategy using after-tax 401(k) contributions. This strategy provided additional long term, tax-free assets which allowed them to free up other shorter-term capital that could be used for a home purchase and tax payments on the exercising of shares.

- The couple saved several thousand dollars in a standard bank savings account, which we recommended they transfer to higher-interest accounts and treasuries, allowing them to earn a higher yield until they made their home purchase.

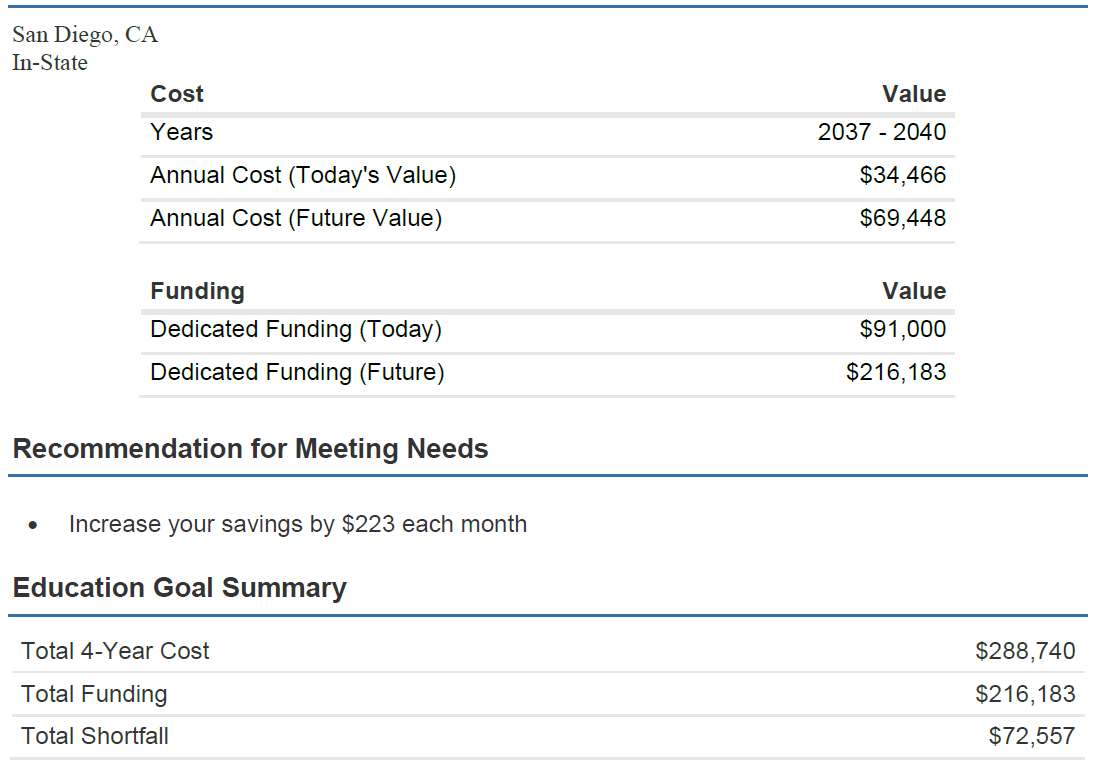

- Maximizing College Plans

- The couple was budgeting for public college tuition and had already begun contributing to a California 529 college savings plan. A benefit they were unaware of was that as California residents, they could use any 529 plan in the country; we switched their plan to another state’s, which offered better investment options and lower fees.

- We also discussed a potential shortfall in their college savings and offered an amount to cover the gap while considering their home purchase and everyday budget.

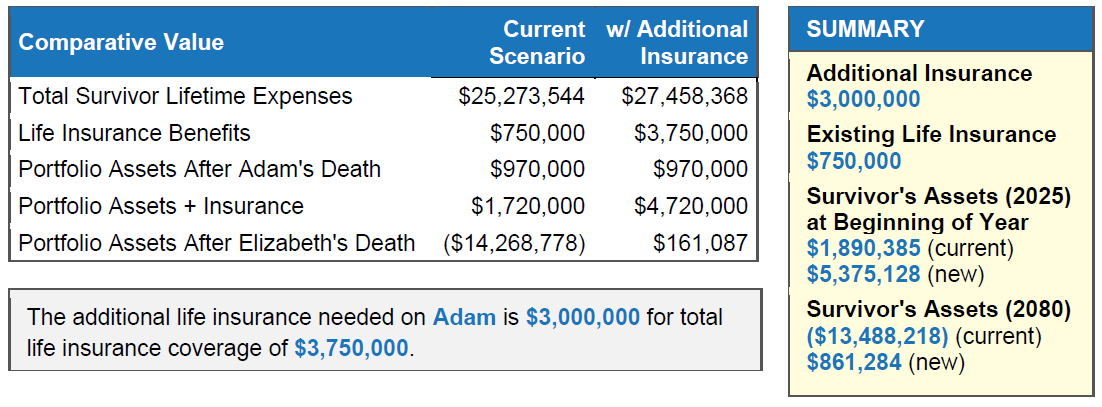

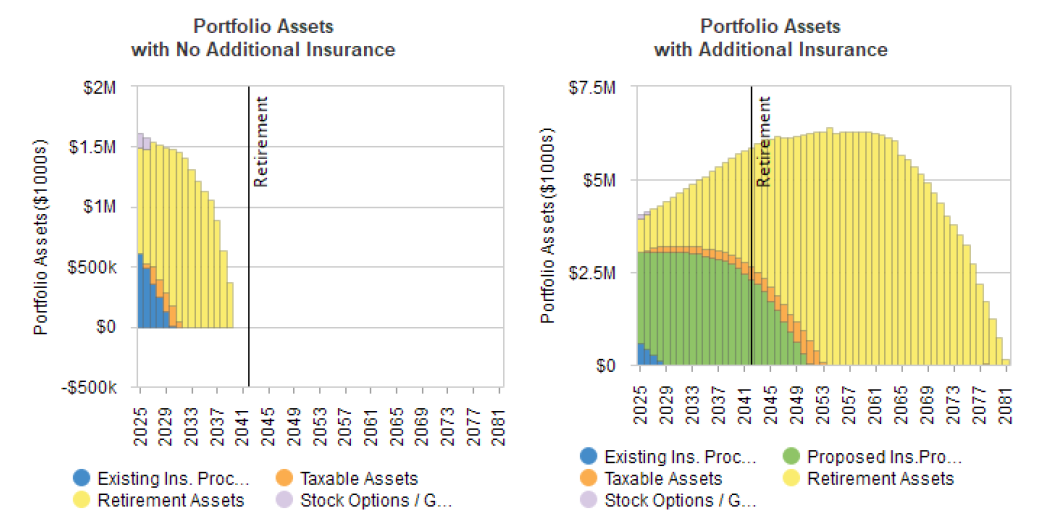

- Insurance Planning

- The couple was unaware of the gaps in their current life insurance plan. We explained if something unexpectedly happened to Adam, Elizabeth, and the kids would be unable to sustain their house payments or regular expenses on Elizabeth’s income alone. As a result, we recommended they add additional coverage to Adam’s life insurance plan and expand their current disability insurance policy for the same reason.

- Estate Planning

- The couple understood an estate plan was essential but didn’t know where to start. We provided the basic elements of their estate plan and a list of questions they should ask themselves before interviewing estate attorneys. We then facilitated conversations between their attorney and the couple to ensure they covered all aspects, including naming guardians for their children.

The Outcome

The couple came to us at a prime time to seize opportunities—when their incomes were growing and their DIY approach needed extra support. With the roadmap, the couple could purchase their dream home while continuing to enjoy their income while their children were still young and their careers were blossoming. Knowing we were a trusted pair of eyes over their shoulder gave them greater peace of mind that they were doing everything they could to optimize what they’d been earning to reach all the goals they had set for their family.

The relationship began out of a single goal of buying a home and expanded to several other areas of their lives, which is critical to a holistic financial plan. We look forward to seeing them reach their goals and see their children head off to college while deepening our relationship for a lifetime.

Are you an executive or professional in a similar financial scenario? Contact our team if you’d like to discuss whether you’re best maximizing your income and benefits to obtain your objectives.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at https://myccmi.com/important-disclosures/

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?