As our families continue to age, we don’t often think that far into the future in terms of what living options could be considered. We want our loved ones to live forever and be healthy enough to take care of themselves, although that is often not the case. When we hear people talk about “assisted living,” we typically imagine a dark and lonely nursing home, so we push that thought to the back of our minds and avoid this type of planning.

Many of our clients who have decided to move from their homes to senior living facilities enjoy the social aspect, or maybe that they no longer have to do yard work. Some have said things like, “it was a gift to our children, so they don’t need to worry about taking care of us” and “we love it here!” They proceed to tell us about things like Tuesday bocce ball or happy hours with friends—and we love seeing our clients thrive!

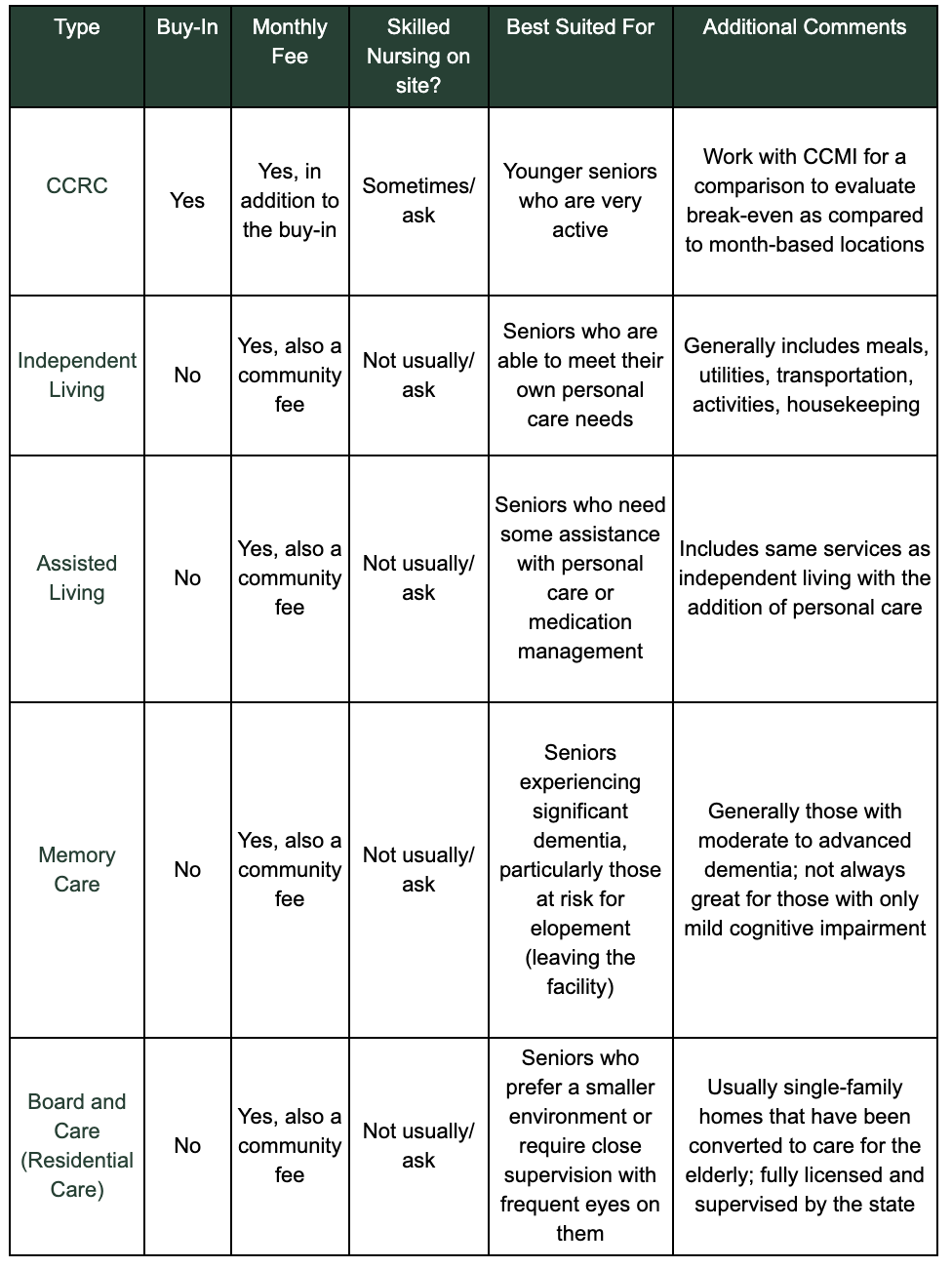

At CCMI, we always strive to educate and empower clients to make the best decisions for themselves. While it may be too early to think about senior living options, it is always good to be informed. Many times, whether it’s for a parent, a spouse or another loved one, we may be forced into the decision if they are showing signs that additional assistance may be needed. The table below summarizes living options for seniors; if you would like more information, check out the video interview with Kim Benson and Brenda-Lee Smith, a nurse with a background in mental health who assists seniors with their best living options.

Please note there are exceptions to each of these options above and cost will vary depending on the extent of services needed and other aspects like facility location and amenities.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?