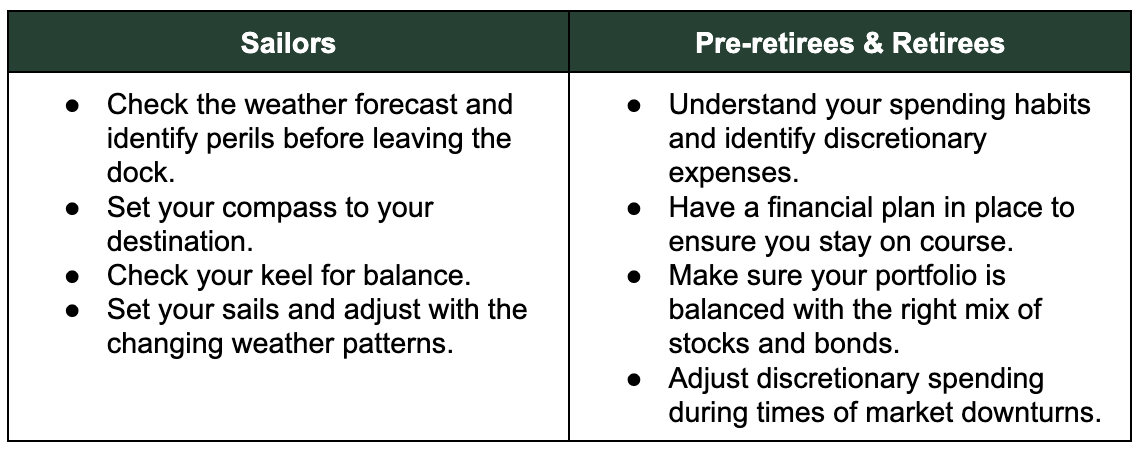

If you have ever been sailing on San Diego Bay, you know how peaceful it can be on the water, with only the wind in your sails moving you forward. If you are a pre-retiree or already retired, you probably strive for that same peaceful, easy feeling in retirement. When sailing, you know the feeling when the wind fades, progress slows or stops, and you are no longer going in the direction or speed you thought you would when you started your journey. Without the wind, you have decisions about adjustments to your plan or face changing course altogether.

Sailing, like life, can be a journey full of uncertainties, from wind speed and direction to tides and swells, sending you tacking into uncertain territory. Analyzing the elements and being able to make tactical adjustments to your sails can help you move in the direction you intended when you started. Comprehensive retirement planning takes that same focus. Like sailing, retirement planning can have moments where the winds of fortune change, requiring adjustments to stay on course.

Sailors and retirees both fear running out of something during their journey. Undoubtedly, one of the most significant concerns for retirees is running out of money during a retirement period that can last 30+ years. Retirement planning concerns can include:

- Managing rising healthcare costs

- Strategizing debt repayment

- Developing a sustainable approach to withdrawing from an investment portfolio when required

So how do you plan and finally embark on your retirement journey? A retirement planning safety checklist is an excellent place to start.

Understand Your Retirement Planning Spending Habits and Expenses

The weather forecast is something a sailor should always be aware of before leaving the safety of the dock. Pre-retirees should be mindful of their current and anticipated spending habits before leaving the safety of a consistent paycheck to ensure they can maintain their current lifestyle and pursue new adventures. With more time to travel and potential health and tax costs, expenses are sometimes higher in retirement. Identify those discretionary spending areas that can be adjusted if needed, like the sails of your boat, as you wait for the wind to fill in to put you back on course. Here are a few more considerations:

- Will you have mortgage payments that extend through your retirement?

- Will you have people dependent on you in retirement, such as children or aging parents?

- Will you retire to an expensive destination like San Diego that may present additional expenses? Consider the pros and cons and extra costs of retiring in San Diego.

- What extra costs related to travel and entertainment do you anticipate that you can integrate into your overall retirement planning strategy?

With projected expenses, you can develop a retirement income target to help manage cash flow and achieve objectives.

Stay on Course During Your Retirement Planning Journey

Having a financial plan in place to document your needs and goals should be the foundation of your retirement planning journey. Think of your financial plan as the compass that helps the sailor stay on course. It is the tool you need to monitor and adjust your retirement planning trajectory. Here are a few components to include:

- Retirement Goals: In addition to financial strategies, envisioning your ideal retirement involves designing a fulfilling lifestyle. Now is the time to define your retirement goals and write down what you hope to do and achieve. Enlist the help of a trusted friend, partner, or financial advisor to share your concerns and goals as you approach retirement.

- Practice Retirement: Simulate retirement for a few weeks. This immersive exercise helps you experience how and with whom you want to spend your time and how much you spend.

- Non-Financial Considerations: Address the non-financial aspect of retirement planning and how you’ll fulfill the basic needs your job provided during your working years. Beyond the core human needs of food, shelter, and safety, retirees often seek three key elements for a fulfilling retirement:

- Structure—This involves a sense of order and establishing a routine or framework for daily activities.

- Purpose—Retirees often seek meaning through activities that provide a sense of accomplishment, personal growth, or positive contributions to the community.

- Community—Maintaining connections and a sense of belonging by forming and nurturing relationships with peers and family is essential for well-being.

Retirement Income Planning

Effective retirement planning includes determining how much income you’ll need to help you develop and implement strategies with your post-career assets. Creating a realistic budget depends entirely on your total expenses and desired lifestyle, so tracking and being fully aware of your costs is critical throughout your life. During your planning, and particularly if you’re five years from retirement, we encourage you to consider these factors as you determine if you have enough to retire:

- Identify all your potential retirement income sources, such as Social Security benefits, pensions, retirement accounts, stock options, and savings. Owning real estate or continuing to work in retirement may provide additional income streams.

- Calculate your regular living expenses while considering changing insurance needs, new goals, spending choices such as an annual vacation or downsizing your home, and taxes.

- Develop a plan to bridge the gap if there is a shortfall. This may involve exploring supplemental income, aggressively saving, or cutting back on current spending to meet your goals.

Develop a Retirement Planning Withdrawal Strategy

Another critical aspect of retirement planning is establishing a tax-efficient withdrawal strategy from your portfolio to cover your cash flow needs. This strategy can be complex and should be thoughtfully constructed, taking into account factors such as:

- Income Sources: It’s important to discuss the structures, distribution, and timing scenarios with an advisor to help create a withdrawal plan tailored to your needs and goals and sustainable over the long term.

- Required Minimum Distributions: Plan ahead for required minimum distributions (RMDs). Because RMDs are considered taxable income, they may also affect your Medicare premiums. An advisor can share how taking RMDs early may affect your income, tax situation, and access to low-cost healthcare.

- Tax Liability: Considering tax implications is critical in retirement planning. Timing your distributions, lowering or increasing your income, anticipating your future tax bracket, or returning to work can all influence how much you owe or save on taxes.

Retirement Planning and Your Asset Allocation Strategy

Is your asset allocation positioned to sustain you for the rest of your life? Equally important (and just as complex) is establishing the appropriate mix of investments within your portfolio that align with your retirement planning objectives. This ensures when you need money, a source will always be available.

Strategically managing your asset allocation within your retirement planning framework can also help you navigate unpredictable waters. Your portfolio must weather market fluctuations, provide for spending, and be balanced enough to fight the effects of rising inflation. Think of your portfolio and asset allocation like the keel of your sailboat, which prevents the boat from being blown sideways and holds the ballast that keeps the boat right-side up. An advisor can help you determine if you should consider lowering your risk, strategize more savings opportunities, or park some money in a safe, accessible investment vehicle like bonds.

Forecast Your Portfolio’s Value, Risks, and Life Expectancy in Retirement

Many retirement planning distribution strategies have been introduced to help determine “safe withdrawal rates.” Strategies include the 4% rule, withdrawing fixed dollar amounts each month, a “bucket” approach, and more.

Many of these strategies fail to address the uncertainty of portfolio returns, inflation, and unexpected expenses from year to year. We refer to this as the sequence-of-returns risk. It is the risk an investor who enters retirement experiences with a market correction early on that results in taking sizable withdrawals from the portfolio to cover expenses. This set of circumstances is often unavoidable and could prove to be detrimental to a portfolio’s longevity. Let’s look at an example to illustrate this risk.

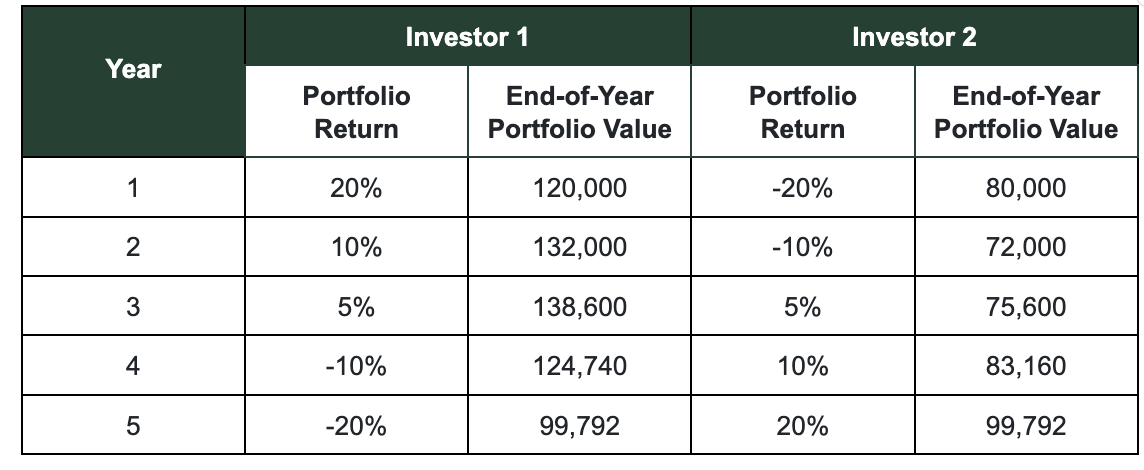

Investors 1 and 2 start retirement with $100,000 in their portfolio, and both experience the same rate of return but in reverse order. Given these assumptions, the table below illustrates that both investors arrive at the same destination after five years.

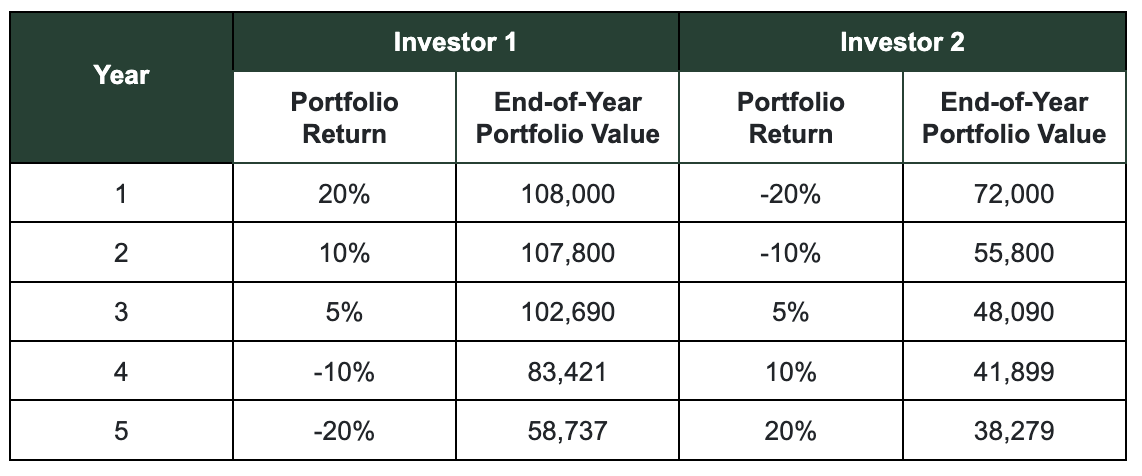

The rate of return assumptions in the next table remain the same but we now add a $10,000 withdrawal from the portfolio at the beginning of every year to cover living expenses.

At the end of five years, the investor who experienced market declines earlier is in a much different situation than the investor who experienced positive market advances earlier, even though both investors spent the same $10,000 per year.

Returning to what we learned in Finance 101, “A dollar today is worth more than a dollar tomorrow.” The investor who had more money to invest earlier ended up with more money, even though both investors spent the same amount each year. Remember, the earlier you plan to retire, the longer your savings will need to last, which can put additional pressure on your investment portfolio, especially during market volatility and low bond yields.

At CCMI, we address the certainty of uncertainty by testing our financial plans using an analysis simulation tool called Monte Carlo. The Monte Carlo analysis illustrates the potential results using 1,000 randomly generated market scenarios of varying returns and volatility. Introducing random investment volatility to the analysis produces a range of values demonstrating how changing market returns may impact future plans and portfolios. Like all strategies, this analysis is not perfect because it is based on historical assumptions. Still, it gives us a guide to address market volatility without a crystal ball.

The illustration above shows the importance of preparing an investment portfolio for spending withdrawals. Retirement planning is an ongoing process that requires regular review and adjustment. We review our clients’ financial plans each year to ensure we have stayed on course. Choosing when to retire is one of the most important decisions of your life, and you should not leave it to guesswork or chance, so planning ahead and during retirement is critical.

Retirement Planning: How CCMI Can Help

We have a proven track record of helping clients transition to retirement in San Diego and around the world and have seen a full spectrum of post-career fulfillment. Typically, the most fulfilled clients have aligned their retirement planning, income, and newfound free time to design a life they genuinely desire. We encourage you to prepare for the weather, control what you can, and make adjustments when necessary.

To recap, here is our checklist:

CCMI’s Personalized Retirement Planning Services

We help walk clients through retirement planning questions to build flexible, adaptable plans that align with their values and aspirations. A carefully curated approach will also help you clarify the emotions that often come with significant transitions like retirement so you can move forward strategically, comfortably, and with greater ease. Retirement can also mark leaving a lifelong career, experiencing an empty nest for the first time, or assuming responsibilities for aging parents. From excitement to apprehension, a range of feelings crop up around retirement. We provide the tools, guidance, and support to help you navigate the transition.

-

- Retirement Income Planning: Plan for tax-efficient retirement withdrawals, navigate decisions around Social Security, and ensure sufficient cash flow for future needs.

- Investment Management: Align your investments, including 401(k) contributions, to support your retirement goals upon leaving your company.

- Strategic Tax Planning: Explore tax-efficient income options to maintain your current lifestyle and create tax-saving vehicles to safeguard your hard-earned assets.

- Generational Planning: Implement practical strategies to secure a comfortable future for your family and subsequent generations.

- Estate and Succession Planning: Collaborate with your professional team to draft estate and succession plans that organize the stewardship of your assets and protect your family’s legacy

- Emotional Side of Retirement Planning: Retirement planning can be emotionally challenging, and CCMI is specially equipped to help clients through this aspect of financial decision-making.

- Planning for the Unexpected: Life rarely goes exactly according to plan. Your retirement plan should be flexible enough to tack and jibe when the weather changes to keep you on course toward your retirement goals.

Whether you’re embarking on a sailing journey in San Diego or your retirement planning journey, being prepared and continually checking your progress will give you the best odds of a successful outcome. If we can help you set that course, please contact us. We would be pleased to embark on and navigate the journey with you.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at https://myccmi.com/important-disclosures/

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?