Have you found yourself reading news headlines and reviewing your investment portfolio with a bit more scrutiny lately? We understand. This year has come with its share of uncertainty. A novel coronavirus and subsequent pandemic have resulted in unemployment, instability across business sectors, and market volatility—with a record decline and peak between February and August.

However, there are indications of hope as the world adapts. We are adopting new health protocols, drawing closer to research that will produce a vaccine for the virus, and seeing all-time highs in the markets as certain sectors have benefited from the changes this year has brought. There is uncertainty, however, as we approach the upcoming presidential election. If you’re wondering how the election’s outcome will affect your long-term investments’ performance, we’d like to share some perspective.

Will the Outcome of the Election Affect Your Investment Portfolio?

Many factors affect the markets, and the U.S. presidential election is only one of them. After reviewing nearly 90 years of historical data from the S&P 500, we have found that there is little evidence for consistent changes in market performance between election years and the years following elections. Generally, the data show that the markets continue to produce positive returns.

Does the Political Party in Power Affect Your Investment Portfolio?

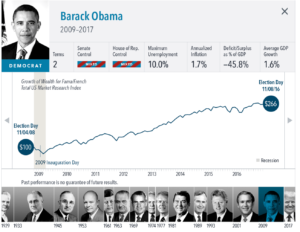

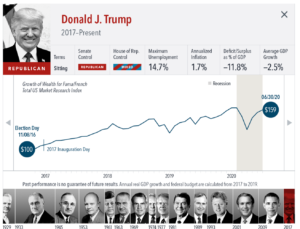

The good news is that the markets have historically rewarded long-term investors under various administrations, regardless of the president’s political affiliation. The S&P 500 data show a consistent upward trend in the U.S. equities markets since the 1930s, and we’re optimistic that will not change with the 2020 election.

The same is true for the political party that controls Congress. While Congress has more influence over the laws and regulations passed that will affect the economy, historical data shows no clear evidence of any significant impact over the market correlating with party control.

Source: Dimensional Fund Advisors

Source: Dimensional Fund Advisors

How Can You Prepare for the Future?

To be clear, there have always been some market reactions and short-term volatility as we approach and undergo election season. However, analysts and investors have also found ways to adapt to fluctuations and changes in political office—and even global events such as the COVID-19 pandemic.

Election year or not, one thing is clear: past market performance cannot predict future performance. It is also true that markets have generally provided positive returns to long-term investors—even in the midst of economic and political shifts. Our goal is to provide our clients with investment plans that value a long-term philosophy, research and data, and diversified portfolios to endure beyond election years and other events.

If you have further concerns or questions about how the world’s events may affect your portfolio or need additional support as you make financial decisions, please contact us. We’d be happy to begin that conversation.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?