As we follow the government’s orders to stay home, many of us are finding ourselves inundated with information and updates on the impact of the coronavirus. Included in this surge of information was the recent Coronavirus Aid, Relief, and Economic Security Act (CARES Act) which was approved by Congress and signed by the President late in the day on Friday, March 27th. Rather than outline the many details of the almost 900-page aid package, we thought it would be helpful to summarize it for you.

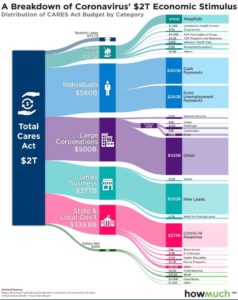

The chart below illustrates how the two trillion-dollar aid package is being distributed and our matching color-coded summary provides information you may find useful in how it may impact you, your community and our country. We have also provided other helpful resources. We want to call particular attention to the Individuals and Small Businesses sections as these contain the most generous and potentially impactful provisions for most clients.

The CARES Act is the largest economic relief package in U.S. history, and is far-reaching in its attempt to help individuals, businesses, governments and other sectors of the economy survive through difficult economic times. While at some point the U.S. will need to address the long-term impact of spending two trillion dollars, for now the CARES Act will provide meaningful relief at a time when it is needed most.

Benefits for Individuals – $560 Billion

- $300b – Recovery rebates of $2,400 for married couples, $1,200 for individuals, plus an additional $500 per child under 17. Please note that phaseouts apply based on Adjusted Gross Income (AGI) above $75,000 for individuals and $150,000 for married couples.

- Considerations:

- In most cases you won’t need to do anything to get your check as the IRS is working with the Treasury Department using information from your tax returns. They will be using 2018 information if you have not yet filed 2019 taxes.

- These checks are expected to be paid out as soon as possible; however, you may not receive your check until May.

- Rebate checks are considered an advance of a refundable tax credit, meaning it’s not taxable even if your 2020 income ends up exceeding the current threshold.

- Considerations:

- $260b for Extra Unemployment Benefits to increase payments by $600/week. The Federal government will cover the one-week waiting period and the extension of benefits by 13 extra weeks. Additional incentives were included to create short-term compensation programs. In summary, unemployment benefits are larger, last longer and more people will qualify. It is the equivalent of paying $15 per hour for 40 hours a week, which will be a raise for some minimum wage workers.

- Resources: State of California EDD COVID-19 Unemployment Information

- If you are not a California resident, please check with your state for unemployment insurance information.

- Resources: State of California EDD COVID-19 Unemployment Information

- Required Minimum Distributions (RMDs) have been suspended from your retirement accounts including: IRAs, 401(k)s, 403(b)s, 457, SEP IRAs or inherited IRAs. This is a great opportunity for tax savings!

- Considerations:

-

- Suspend or skip your RMD for 2020 if you do not need the cash and/or consider taking the cash you need from a brokerage account for more favorable tax treatment.

- If you’ve taken your RMD from your retirement account within the past 60 days, you can put the money back; however, you may not receive a reimbursement of any taxes withheld until you complete your 2020 taxes next year.

- Due to events surrounding the coronavirus and potential associated benefits lowering your 2020 income, it may be a good time to explore Roth conversion options.

-

- Resources:

-

- CCMI has been proactively working with our clients to assist with these RMD updates. You may also contact your CPA to see what strategy is best for you.

-

- Considerations:

- Extended 2019 Tax Filing and Payments – date has been changed to July 15, 2020. The April 2020 quarterly estimated tax payment is not due until July 15, 2020. However, the June 15 and September 15 payments are still due on those dates.

- Considerations:

- Consider filing your 2019 tax return if you haven’t already, especially if you expect a refund or as a precaution to receive the recovery reimbursement check mentioned above.

- If you owe tax for 2019 and are not expecting a recovery reimbursement, consider delaying filing your taxes until July 15, 2020.

- Considerations:

- Charitable giving updates include an above the line deduction of up to $300 for cash donations to charities and is available for those who do not itemize deductions. The 2020 charitable contribution limitation for individuals will now be 100% of adjusted gross income if you donate directly to charity.

- Considerations:

- If you are charitably inclined, you can significantly reduce or completely offset your 2020 income through increased charitable contributions.

- Contributions to Donor Advised Funds are not included.

- Considerations:

- Allows Early 401(k) and IRA Distributions, and Loan modifications to facilitate withdrawals if needed. Hardship distributions have doubled to $100,000 and the 10% penalty for those under age 59½ has been waived. Withdrawals are taxable but can be paid over three years. Loans from a 401(k) can be taken up to lesser of $100,000 or the vested balance. Any new or existing 2020 loan repayments due can be delayed for a year.

Benefits for Small Business Owners – $377 Billion

- $350b – New Loans for small businesses of less than 500 employees and select types of businesses with fewer than 1,500 employees are available. Includes a separate provision which will forgive some or all of the loan depending on timing and the how the funds are used. It also expands eligibility for the SBA’s Economic Injury Disaster Loan.

- Deferral of payment of 2020 Payroll Taxes where 50% will be due on 12/31 of 2021 and the remaining 50% will be due on 12/31 of 2022. This applies to self-employed individuals as well for the ‘employer’ portion.

- Considerations:

- Contact your bank to see if you may qualify or benefit from these new loan relief programs.

- Consider deferring your 2020 payroll taxes as illustrated above, knowing that taxes will still be owed but can now be deferred.

- Resources:

- Considerations:

- Net Operating Losses (NOLs) can be carried back up to 5 years and applied to 2018, 2019, or 2020 NOLs, which accelerates a tax refund for immediate use. NOLs will now be able to offset 100% of taxable income (up from 80%).

- $17b – Relief for Existing Loans to cover six months of payments for small businesses already using SBA loans.

- $10b – Emergency Grants up to $10,000 to provide emergency funds for small businesses to cover immediate operating costs.

Benefits for Large Companies – $500 Billion

- Establishes a fully refundable tax credit for businesses that are closed or distressed to help keep workers on payroll. Provides oversight on pandemic recovery and bans stock buybacks for any company receiving a loan under the program for the term of the loan plus one year. Specific funds allocated to airlines to keep them open and assist with wages and benefits.

Benefits for State and Local Government – $339.8 Billion

- $274b – Specific coronavirus response efforts.

- $65.8b – Direct Aid for state and local governments including K-12 schools, higher education and programs for children and families who may be running out of cash due to high number of cases.

Benefits for Public Health – $153.5 Billion

- $100b – allocated to hospitals responding to the coronavirus.

- $53.5b – allocated to various health related organizations including community health centers, veterans’ health care, telehealth, medicine and supplies.

- Definition of eligible medical expenses has been expanded to include over-the-counter medications for Health Savings Accounts (HSAs), Medical Spending Accounts (MSAs) and Flexible Spending Accounts (FSAs).

- Medicare Part D recipients can request up to a 90-day supply of medication to reduce the number of times at-risk individuals need to visit the pharmacy.

- Telehealth services are temporarily covered by HSA eligible High Deductible Health Plan (HDHP).

- Considerations:

- Contact your pharmacist to update your prescriptions to a 90-day supply if you are a Medicare Part D recipient.

- Consider expanded eligible medical expenses and telehealth services if needed and if applicable to you as outlined above.

Benefits for those with Student Loans – $43.7 Billion

- Federal student loan payments are deferred until September 30, 2020. No interest will accrue during the interim. Loans eligible for forgiveness programs will continue to be eligible. Involuntary debt collections on Federal student loans also suspended.

- Considerations:

- Contact your Federal student loan provider to stop required payments until September 30, 2020.

- Students on Pell grants who left school early due to illness will not have to pay them back.

- Employers can exclude student loan repayments from employee compensation.

Safety Net – $26 Billion

- $8.8b – Schools for more flexibility to provide meals for students.

- $15.5b – Supplemental Nutrition Assistance Program (SNAP) to cover the cost of new applications as a result of the coronavirus.

- $450m – Food banks and other community food distribution programs.

We hope this post provides you with a high-level overview of the many provisions in the CARES Act. While we did not provide every detail of the nearly 900-page legislation, please let us know if there are specific questions you have about any of these programs and we can assist you with finding an answer to your question. We will do our best to keep up with all of the changes and keep you informed of the relevant information. We expect more action from Congress later this year if this situation continues to persist and will undoubtedly have more legislation to interpret and share with you then. For now, we hope you are safe, healthy, and please let the CCMI team know if we can assist you with looking into any of these areas.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?