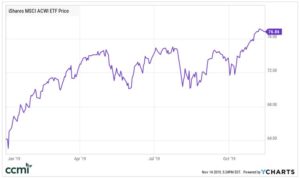

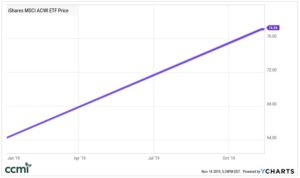

At Schwab’s recent IMPACT conference in November, there was a presentation about a concept called “investor volatility,” which is different than market volatility. Here’s an example: If you look at the two stock charts below representing the iShares MSCI ACWI ETF, which investment experience would you prefer as an investor? Both investments offer the same 20% return over the same period of time (Jan – Nov 2019):

Just about everyone will pick the second option where an investor earns a 20% return and has no perceived volatility with a virtual straight line of investment return.

The interesting part of this exercise is that the difference in volatility between the first chart and the second chart is that the first chart represents the volatility that an investor experiences when they check their investment every single day, whereas the second chart represents the volatility for an investor that checks their investments once or twice a year. If an investor infrequently checks their portfolio balances, they experience less of the market volatility and generally will feel less stress and anxiety related to their investments, but will still earn the same returns as a person who checks values daily. You can effectively turn the top chart into the bottom chart in terms of how volatile your portfolio feels to you.

While this does not mean that investors shouldn’t keep an eye on what they own or ignore their portfolio, it does illustrate how much investor anxiety and perceived volatility is tied to not only actual volatility, but also to investor behavior.

Have questions about your portfolio and your “investor behavior?” Give CCMI a call to speak to an advisor about how your investor volatility may impact your portfolio performance.

(Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Creative Capital Management Investments LLC (“CCMI”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CCMI.)

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?