Do you regularly make charitable donations? Do you have an investment account with appreciated holdings that are outside of your retirement accounts? If so, we wanted to share something you should consider.

One of the significant changes of the Tax Cuts and Jobs Act that reshaped our tax code at the beginning of 2018 was that the standard deduction was effectively doubled. The IRS estimates that less than 10% of Americans will now claim itemized deductions, down from about 30% in 2017. This will leave millions of taxpayers who previously itemized their tax deductions now filing a standard deduction for the first time in many years.

The impact of this change has a unique impact on gifts to charity, which is a commonly utilized itemized deduction. The new law presents an opportunity to actually increase your overall tax deductions while still giving charities the same amount of money over time. It is known as “bundling” charitable contributions via a Donor Advised Fund.

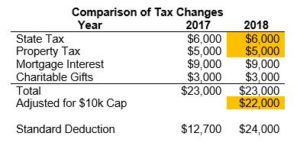

For many years, most higher earning taxpayers (especially in high-tax states like California) would itemize their tax deductions. The standard deduction for a married couple was $12,700 prior to the new tax act. So, for many people, if their mortgage interest, state tax paid, property tax paid, and charitable contributions were greater than $12,700, they would itemize their deductions – which therefore implies that they were getting the full tax benefit of the deduction for their charitable contributions. For example, if someone’s state taxes paid were $6,000, plus property tax of $5,000, and mortgage interest of $9,000, they were already above the $12,700 standard deduction before even factoring in charitable gifts under the old law.

Under the new tax act, using this example above, the state tax paid and the property tax paid are now capped at a combined $10,000 for deduction purposes. In this example the couple would lose $1,000 of their previous state tax and property tax deduction (it was $11,000 combined, but is now limited to $10,000). However, the bigger change is that the standard deduction is no longer $12,700 for a married couple, it is now $24,000. If we add $3,000 of charitable gifts to the mix, let’s compare how their situation would appear on their Schedule A under the old and new tax law.

Now let’s look at that same couple and the same gift under the new tax law. They now have only $22,000 of eligible deductions because they lost $1,000 of deductions due to the new cap for state and local taxes at $10,000. With a new standard deduction limit of $24,000, they are better off filing for standard deduction rather than an itemized deduction because it nets them $2,000 more in tax deductions ($24,000 vs. $22,000). As a result, the couple doesn’t receive a tax benefit from their charitable contribution because they aren’t really deducting any of their $3,000 charitable contribution. They would file the standard deduction with or without that $3,000 charitable gift because under this scenario they would be better off using the standard deduction.

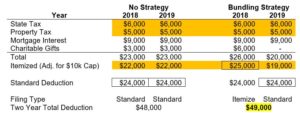

So how does this relate to the strategy of “bundling” your charitable gifts via a donor advised fund? This strategy takes advantage of this new tax law. Continuing with our example above, the couple made a $3,000 gift and didn’t receive a deduction for it. What if they made a $6,000 gift instead, for just the first year? Now they would be an itemized taxpayer for this year because their total eligible deductions would be $25,000 rather than $22,000. They would now get to deduct $1,000 more than the standard deduction for this year.

You might be thinking – well yes, BUT they also donated an extra $3,000 – which is true. However, by using a donor advised fund and gifting appreciated stocks to fund the account, you can bundle the gifts into one year and get a full charitable tax deduction for that year, but you don’t actually have to send the money to a charity until a future year. This is a unique feature of a donor advised fund. So, in effect you could make a $6,000 deduction this year to the donor advised fund, distribute $3,000 out of the fund this year and send it to a charity, and then send the other $3,000 next year. Over a two-year period, the charity still receives $3,000 per year but you get the full $6,000 deduction in the first year where it is worth more to you (rather than get no charitable deduction if the facts remain the same and you were to gift $3,000 annually).

Let’s turn back to the taxpaying couple – they received a $6,000 deduction this year for the gift to the donor advised fund, and as a result they claimed an extra $1,000 of deductions beyond the standard deduction. But what happens next year? Next year, they won’t claim ANY charitable deduction because next year’s gift to charity will come from the donor advised fund, for which they’ve already received a deduction. Next year, they will claim the standard deduction because their remaining eligible deductions are only $19,000 (state and property tax capped at $10,000, plus $9,000 of mortgage interest). Next year as a standard deduction filer they will get an extra deduction of $5,000 ($24,000 standard deduction minus the $19,000 itemized deduction).

Overall, the couple is better off by $1,000 after doing this extra step because they were able to create $1,000 of allowable itemized deductions by “bundling” their gift in the first year and exceeding the standard deduction instead of claiming an itemized deduction. In the end, the charity still gets $6,000 over two years and the couple is able to utilize their gift to maximize their tax deductions.

This concept can be applied to much larger gifts if desired. This is a tax strategy that we recommend our clients consider when doing their philanthropic planning, and we encourage clients to review these options with their tax preparers.

If you’d like to discuss this concept further, please call our team. Likewise, if there is someone in your network that engages in philanthropy that would benefit from this type of tax planning, we would be happy to speak with them.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?