If you have company stock in your 401(k) plan, you should be aware of a potentially valuable tax strategy that could greatly reduce your tax burden when you begin withdrawing money in your retirement years.

Upon retiring or leaving their company, many people end up rolling over their 401(k) plan to a Rollover IRA but are not aware of the tax strategy called Net Unrealized Appreciation, or NUA. The NUA strategy may be right for you if a) you have a sizeable amount of company stock in your 401(k), b) you know the cost basis of your shares in the company stock and c) that stock is highly appreciated. The NUA option essentially exchanges ordinary income tax rates for more favorable long-term capital gains tax rates on the unrealized capital gain in your shares of company stock in the 401(k) plan.

It is important to work with your CPA and/or a fee-only CFP® professional to decide if the NUA option is right for you. There can be costly consequences if it is not completed properly.

- What is Net Unrealized Appreciation (NUA)?

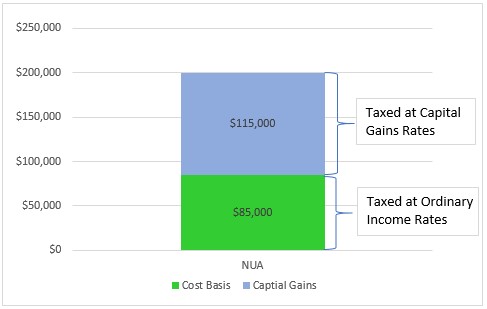

The Net Unrealized Appreciation (NUA) is the difference between the cost basis of your shares and the current market value of your shares held in a pre-tax 401(k). As a simple example, if your company stock in your 401(k) is worth $200,000 and the original purchase price of your shares is $85,000 (known as the “cost basis”), the NUA is $115,000.

- How does the NUA strategy work?

- First, you would withdraw the company stock portion from your 401(k) and distribute it in-kind to an after-tax brokerage account. In the year you complete this transfer, you would pay ordinary income taxes on the original cost basis of the stock ($85,000 in the above example). This establishes your after-tax cost basis in the shares that are now outside of your 401(k). You will be subject to a 10% penalty if this is done before age 55.

- When the stock is sold from the taxable account, the NUA, or the $115,000 of appreciation, would be taxed at more favorable long-term capital gains rates, regardless of how long the stock was held (up to the NUA amount). Any subsequent gain above the NUA amount would need to be held for at least 12 months to receive long-term capital gain tax treatment.

- Within the tax year of the stock transfer, you need to rollover the remaining balance in your 401(k) plan, likely through a rollover to an IRA. Your 401(k) balance at the end of the year must be zero in order for the transaction to be done properly.

- The distribution must be made after a qualifying event such as separation from service, disability, etc.

- What is the potential financial benefit?

Continuing with our example where you have $200,000 in company stock in your 401(k) with a cost basis of $85,000: if you use the NUA strategy by transferring all company stock to a brokerage account and selling the shares immediately, the resulting transaction would result in $27,945 of capital gains tax (15% federal tax, 9.3% CA state tax on $115,000 in gains), on top of the $37,655 you would have paid in ordinary income tax on the $85,000 (Assuming a 35% federal tax rate and a 9.3% CA state tax rate). Your total tax paid is $65,600 on a $200,000 distribution and sale, which is an effective tax rate of 33%.

Continuing with our example where you have $200,000 in company stock in your 401(k) with a cost basis of $85,000: if you use the NUA strategy by transferring all company stock to a brokerage account and selling the shares immediately, the resulting transaction would result in $27,945 of capital gains tax (15% federal tax, 9.3% CA state tax on $115,000 in gains), on top of the $37,655 you would have paid in ordinary income tax on the $85,000 (Assuming a 35% federal tax rate and a 9.3% CA state tax rate). Your total tax paid is $65,600 on a $200,000 distribution and sale, which is an effective tax rate of 33%.

If instead you had simply completed a 401(k) to IRA rollover and then taken out $200,000 all at once or over a number of years, assuming the same ordinary income tax rates, you would have paid $88,600 in state and federal taxes, which is a 44% effective rate. As a result, you would have paid an additional $23,000 in taxes as a result of not using the NUA strategy.

- Is it right for me?

- You have a sizeable amount of your 401(k) invested in your employer’s stock.

- The stock in your 401(k) has appreciated substantially.

- You are in a high tax bracket. For example, based on current tax code, if you are in a 35% federal tax bracket, your long-term capital gain rate would be 15%, resulting in 20% tax savings on a portion of your portfolio. Please note that your decision to determine if NUA is right for you should be re-evaluated with any future changes to the tax code.

- Lastly, there are many reasons (which we won’t list here) why you should not pursue the NUA option, so it is important to discuss your options with a CPA and/or a fee-only CFP® professional. One common reason not to complete an NUA transaction would be if you do not expect to need to take any money out of the IRA for many years, since the tax savings is only relevant when comparing the NUA cost to the cost of actually making the equivalent IRA withdrawal.

Conclusion

Utilizing the NUA strategy may save you money on taxes and should be evaluated by a CPA and/or a fee-only CFP® professional to determine if you are a suitable candidate. There are also many other considerations that should be evaluated, such as when you might need the money, the breakeven point, and possibly doing a partial distribution. In some cases, there may be reasons why it is not suitable for you, regardless of whether you meet the criteria. Additionally, as it may be risky to accumulate such a large balance of company stock in your 401(k), there are other strategies you can implement in the years leading up to retirement, which may be preferable to the NUA option. These options should be reviewed with a CPA or a fee-only CFP® professional. Please let us know if we can help.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?