Comprehensive retirement planning involves managing factors such as market fluctuations, inflation, or an unexpected income change in your family. These situations may feel concerning, especially for your long-term savings and financial future. So, it’s natural to think you should proactively do something to mitigate the risk. Life is unpredictable and dynamic, so flexibility and adaptability are crucial for retirement planning. They enable you to make necessary adjustments to align your goals with changing circumstances and address unforeseen situations without hindering your finances.

However, avoiding hasty or reactive decisions that may affect your retirement plan or your bigger financial picture is imperative. For example, specific issues can impact important short and long-term goals, such as your target retirement date or missing opportunities once the market recovers. You can generally avoid these issues with a disciplined approach and financial plan in place. Still, amid market changes, you may wonder if your situation warrants action.

Should I Make Changes to My RTX (Raytheon Technologies) 401(k)?

When change arises, clients often wonder what they can do to reduce their risk or optimize their strategies, such as adjusting their financial or retirement plans during high inflation. The answer is unique to everyone and depends on your individual financial situation, risk level, and goals. As a general guideline, you should first review your circumstances and concerns with a financial advisor who can help you explore other retirement planning scenarios and offer suggestions, such as making shifts or staying the course. Another essential component is to partner with a professional who understands the features and mechanics of your particular employer-sponsored retirement plan, which may present additional factors to consider.

CCMI Insights into the RTX Savings Plan

As financial advisors in San Diego, we often consult with Collins Aerospace employees, the division of RTX (Raytheon Technologies) located here, and we are familiar with the RTX 401(k) plan, RTX benefits, and some key changes that went into effect recently. We’ll discuss three typical scenarios and the related actions you should consider if you’re evaluating your RTX retirement plan.

RTX (Raytheon Technologies) 401(k) Situation #1

Employee Financial Situation and Characteristics:

- You still have some working years ahead of you.

- You have fully funded your emergency savings.

- You have a financial plan and cash set aside for any upcoming large expenses.

- You find yourself with more than enough cash.

Retirement Plan Action to Consider: Maximize Your RTX Retirement Plan

- Buy more stocks: Consider buying more stocks when prices go down as a normal part of the market cycle, which better positions you for the eventual recovery. There are additional considerations and common mistakes to be aware of and avoid if you hold company stock.

- Maximize 401(k) contributions: Take advantage of your excess cash. If you are not currently maximizing 401(k) contributions, consider increasing to a point that does not strain your cash flow. Maximize 401(k) contributions by contributing up to $22,500 if you are under age 50 or up to $30,000 if you are 50 or older (2023 limits).

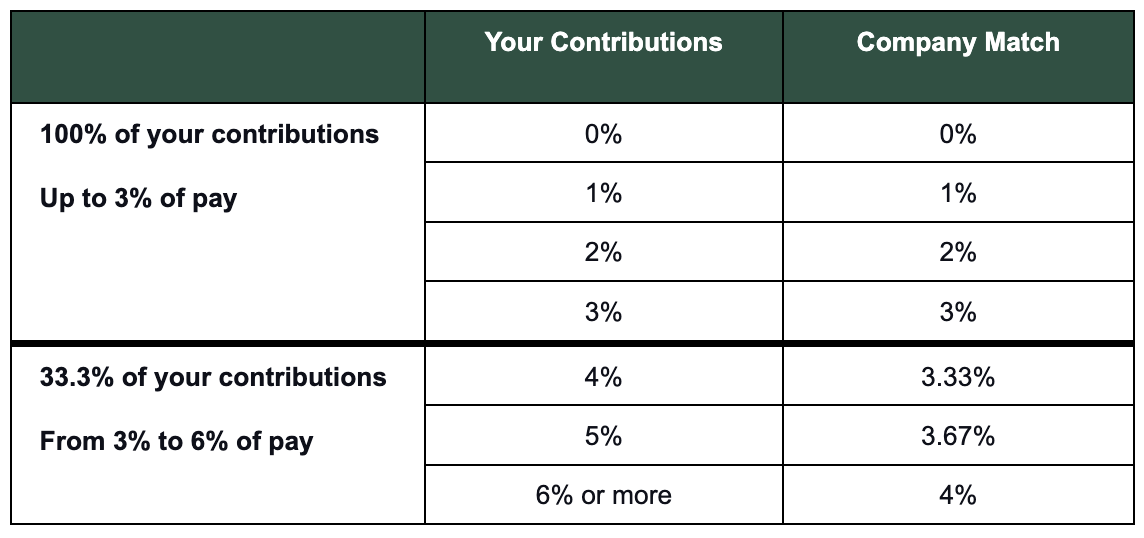

- Leverage the RTX 401(k) match: Currently, RTX matches up to 4% of your salary for up to 6% of your pay period contributions, as shown below:

Additionally, they offer company retirement contributions if you are not actively accruing a pension benefit based on your age as of December 31st of each calendar year. This can be up to an additional 7% per pay period or more in some cases. You receive these contributions whether or not you contribute to the savings plan.

- Consider excess 401(k) contributions and Roth conversions on eligible balances:

- The RTX 401(k) allows after-tax contributions beyond the above limits.

- This option allows you to contribute a total of $66,000 in 2023 by aggregating the employee contribution, employer match, and excess contributions. Reach out to CCMI if you would like to review your pay stub to determine the amount of the excess contribution based on your specific situation.

- RTX Savings Plan participants may convert some or all of their eligible balances to a Roth account. Roth account withdrawals are tax-free, and there are no required minimum distributions (RMDs) at age 73, such as those on pre-tax 401(k) contributions, which are fully taxable. Please note legislation may alter this option in the future.

- While it has been confirmed that RTX will stop contributions once the limit is reached, you want to be mindful of not exceeding total allowable contributions.

- Review your RTX investment allocation: Ensure your mix is diversified and aligned with your long-term goals. Additionally, you can take advantage of net unrealized appreciation (NUA), a tax savings strategy, if you have RTX stock in your 401(k). Consider how much company stock you have, as you want to limit your exposure to any one company, especially the one where you are employed.

Remember to maintain a long-term perspective and understand that markets go through cycles so you can continue to benefit from compound growth through the rest of your working years ahead.

RTX (Raytheon Technologies) 401(k) Situation #2

Employee Financial Situation and Characteristics:

- You feel the impact of factors such as higher inflation on your bottom line.

- You have funded emergency savings but may not have any surplus cash.

- You may have put a hold on any large upcoming expenses.

- The current market and economic conditions have been weighing on you.

Retirement Plan Action to Consider: Stay the Course

- Continue leveraging the RTX 401(k) match: Consider continuing to contribute to your 401(k) of at least up to 6% of your salary so the free money from RTX’s match is not left on the table.

- Maintain your allocations: If you already have a balanced allocation that is aligned with your long-term goals, continue to target this allocation. If not, consider reaching out and CCMI can assist with finding the right balance using the funds available in your RTX plan.

- Focus on cash flow management: Rather than making changes to your 401(k) at this time, you can consider tracking your expenses, finding potential areas for savings, and adjusting your budget to alleviate cash constraint concerns.

RTX (Raytheon Technologies) 401(k) Situation #3

Employee Financial Situation and Characteristics:

- You feel very stressed and may be losing sleep over current market and economic conditions.

- You do not have emergency savings, or it is running low.

- Other unanticipated expenses have come up, and you require more cash.

Retirement Plan Action to Consider: Temporarily Change

- Reduce your RTX 401(k) contributions: If you have been contributing to your 401(k), you may need to reduce your contributions temporarily to help see you through this period. This will allow you to redirect some funds toward pressing cash needs while still supporting your long-term retirement goals.

- Avoid early 401(k) withdrawals or “going to cash.” While financial stability is an immediate concern, avoid liquidating your assets entirely, as you may miss future opportunities when the market recovers. Stocks do not fall to the ground nor do they grow to the sky. Change is a normal part of the market cycle, and it’s normal to feel uneasy. Now is the time to stay put unless you have a unique situation that requires a change to your allocation.

- Reassess periodically. If you are unable to stay the course and end up making changes to either your contribution or allocation, schedule reminders to reassess your situation. Staying engaged in your financial situation can help you determine when you can begin to build up your emergency fund and get back on track with your retirement goals.

Market turnarounds happen quickly, and it would be unfortunate to miss out on any growth for too long. Think about the Global Financial Crisis of 2008, a severe event that caused significant market declines. During that time, many investors pulled their money from the market out of fear or uncertainty, while those who stayed the course benefited from the eventual recovery. In hindsight, it would have been a good decision to stay invested as you would have missed out on the market appreciation since then, had you “gone to cash.”

The Emotional Side of Financial Decision-Making

Managing emotional decision-making is critical when unplanned or outside factors affect our money or financial security. When you can avoid making snap decisions or drastic changes, you can more clearly monitor your situation and take balanced next steps. Sometimes, patience is the best option. As a Certified Financial Transitionist®, CCMI principal and owner Kim Benson, CFP®, CPA, CeFT®, also possesses the skills that help her relate to clients’ changing needs and provide a sense of calm around major decisions during stressful or uncertain times.

Frequent changes to a retirement plan can lead to emotional stress and anxiety, especially if they are driven by fear or panic in response to market volatility. Emotional decision-making can lead to irrational choices that may not align with long-term goals. There will always be changes, market fluctuations, and unexpected life events that may affect your income needs or the future of your retirement nest egg. It is why it’s crucial, as ever, to have a solid foundation in place to find a clear path forward and walk ahead confidently. We encourage you to stay informed, take necessary action, and discuss your concerns with your financial advisors to help you gain more peace of mind.

Other Retirement Planning Challenges

Your 401(k) is a significant piece of your comprehensive financial plan, and decisions around it should not be taken lightly. Other retirement planning challenges we typically see include:

-

- Underfunding or overfunding: Underfunding occurs when you do not save enough for retirement due to changes in income, high expenses, or other factors that could affect your standard of living and retirement goals. Overfunding or contributing excessively to your retirement accounts could result in tax penalties or risks. Ensure you understand contribution limits based on the various components of your plan, especially if you have multiple retirement accounts.

- Misalignment of the allocation with goals: Your goals, risk tolerance, and years until retirement should help determine how you allocate your investments. For example, if you have a longer time horizon, you may be comfortable with more risk and aggressive allocations, while preserving savings typically becomes a priority as retirement quickly approaches. A financial advisor can help you through various scenarios based on your investment guidelines, age, and other factors.

- Improper levels of risk in both directions: While everyone has a unique risk tolerance, taking on too much risk can be a problem during market changes, causing significant stress, especially if your retirement accounts will make up your primary income. On the other hand, an overly conservative approach may not provide the growth you’ve expected, affecting your retirement and wealth accumulation goals.

- Overconcentration of company stock: This occurs when you hold a large portion of stock in your retirement account in a single company. Since the stock’s value is tied to the financial health and performance of the company, if it faces difficulties, you could jeopardize a significant part of your savings. Ensure you regularly monitor and diversify your allocations across different investment types to manage over-concentration risk.

We Understand the RTX Retirement and Benefits Plan

We’re uniquely positioned to help RTX employees, which includes Collins Aerospace employees, navigate their RTX retirement and benefits. Kim Benson is a previous employee, familiar with the RTX 401(k) plan. She often advises prior colleagues regarding the program and shares her insights into common 401(k) situations employees may face. Our team can help you with the following:

- Invest your excess cash flow with purpose during your peak professional years. We can help you strategically invest according to your preferences while identifying growth opportunities considering your short and long-term needs.

- Prioritize your assets to buy your first home, invest for the future, save for children’s education, or navigate an emergency. We’ll help you establish clear priorities to achieve your most important objectives in a sequence that makes sense for you.

- Manage your stock options and other corporate benefits as your income grows. We can assist in integrating your compensation into your overall financial plan so you can make informed decisions regarding exercising options or purchasing stock.

- Explore tax-efficient strategies and tactics, such as tax-loss harvesting, to increase and optimize your retirement savings and minimize your liabilities.

- Reassess your risk tolerance. Your risk tolerance may change as your financial situation evolves, or you experience major life events. We can guide you through allocations that align with your comfort level and how they will affect your overall retirement plan.

- Diversification and asset allocation. We can help you manage risk, create a diversified mix of assets tailored to you, and rebalance periodically to ensure you stay on target.

- Explore alternative investments and inflation protection. If you’d like to explore other investments to supplement your employee retirement account, we can help present various options, including inflation-protected investments and their benefits. We can also help you through strategies to manage high inflation once you’ve retired.

Everyone’s situation is different, and you should review your time horizon, cash flow needs, and other factors with your financial advisor and/or CPA. Your RTX 401(k) is a single component of your overall financial picture. Our team of financial planning professionals is happy to have a complimentary conversation to discuss your 401(k) options from RTX or another employer and assist you in developing a comprehensive plan that considers all aspects of your financial life.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at https://myccmi.com/important-disclosures/

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?